Stop Losing Money! The Accounting Skills Every Business Owner Needs (Right Now)

May 26, 2024

From Broke to Booming: The Ultimate Guide to Small Business Financial Performance

June 3, 2024Part 1: Understanding Accounts Payable vs. Accounts Receivable

Ever wondered where your business money goes, or where it’s coming from? The answer often lies in two crucial accounting concepts: accounts payable (AP) and accounts receivable (AR). While they may sound similar, understanding the difference between these two is essential for maintaining a healthy business.

I. Introduction

Imagine your business as an ecosystem. You provide goods or services, and in return, you receive payment. But this flow of money isn’t always instantaneous. Sometimes, you might purchase supplies from vendors on credit, creating a temporary debt. Other times, you might sell products to customers who haven’t paid yet. This is where accounts payable and accounts receivable come into play.

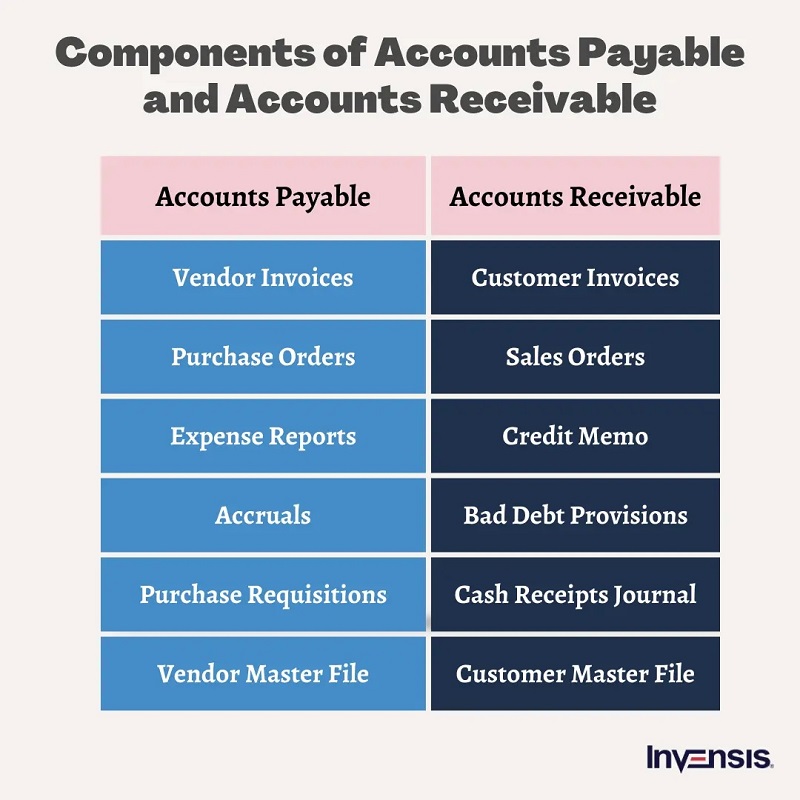

II. Demystifying Accounts Payable (AP)

Accounts Payable represent the money your business owes to suppliers for goods or services you’ve already received. It’s essentially a short-term liability, meaning it needs to be settled within a specific timeframe, usually less than a year. Here are some key points to remember about AP:

- Represents a short-term liability: Outstanding invoices, accrued expenses (like rent or salaries not yet paid) all fall under AP.

- Maintaining good relationships: Timely payments to vendors are crucial for building strong supplier relationships and securing favorable terms in the future.

- Managing cash flow: Efficient AP management helps you track your outgoing funds and plan for upcoming payments, ensuring smooth cash flow.

III. Diving into Accounts Receivable (AR)

On the flip side, accounts receivable represent the money owed to your business by customers who have purchased your goods or services on credit. This money is essentially an asset you expect to collect within a specific timeframe, typically a year or less. Here’s a closer look at AR:

- Represents a current asset: Outstanding invoices from customers make up your accounts receivable.

- Maintaining positive cash flow: Effective AR management ensures a steady stream of incoming funds, which is vital for maintaining positive cash flow.

- Managing collection efforts: Having a clear collection process in place helps you recover outstanding payments efficiently and minimize bad debt.

IV. Key Differences Between Accounts Payable and Accounts Receivable

The core distinction between AP and AR lies in who owes whom. Accounts payable represent your business’s obligation to pay, while accounts receivable represent the money you are entitled to receive. This seemingly simple difference has a significant impact on your financial statements, as AP is categorized as a liability, and AR is considered an asset.

V. The Yin and Yang of Business

Think of AP and AR as the yin and yang of business finance. They are interconnected concepts that influence each other. A healthy balance between the two is crucial. Efficient AP management can free up cash flow for early payment discounts from vendors, while effective AR management ensures a steady inflow of funds to meet your financial obligations.

Part 2: Managing Accounts Payable and Accounts Receivable

VI. Optimizing Accounts Payable (AP) Management

Efficient management of your accounts payable ensures timely payments, strong vendor relationships, and optimal cash flow. Here are some key strategies to consider:

- Streamlining invoice approval process: Automate workflows and approvals to avoid delays in processing invoices.

- Utilizing early payment discounts: Many vendors offer discounts for prompt payment. Taking advantage of these can save your business money.

- Negotiating favorable payment terms: Negotiate longer payment terms with vendors whenever possible to improve your cash flow.

- Leveraging technology for automation: Utilize accounting software or accounts payable automation tools to streamline invoice processing, data entry, and payment approvals.

Benefits of Effective AP Management:

- Improved cash flow: By optimizing your payment schedule and utilizing discounts, you can free up cash for other business needs.

- Stronger supplier relationships: Timely payments demonstrate reliability and strengthen your relationships with vendors, potentially leading to better deals in the future.

- Reduced risk of errors and penalties: Automating AP processes minimizes human error and ensures timely payments, avoiding late fees and penalties.

VII. Mastering Accounts Receivable (AR) Management

Effective AR management ensures a steady stream of incoming revenue and minimizes bad debt. Here are some key strategies to implement:

- Implementing clear credit policies: Establish clear creditworthiness criteria and define your payment terms upfront.

- Sending timely and accurate invoices: Ensure invoices are accurate and sent promptly to avoid delays in payment.

- Offering convenient payment options: Provide customers with multiple and user-friendly payment options such as online payments, credit cards, or electronic checks.

- Establishing a collection process with clear communication: Develop a systematic collection process with clear communication protocols to follow up on overdue payments.

Benefits of Effective AR Management:

- Reduced bad debt expense: Proactive collection efforts minimize the risk of unpaid invoices, leading to a healthier bottom line.

- Improved cash flow: Timely payments from customers ensure a steady flow of cash to cover business expenses and investments.

- Enhanced customer satisfaction: A streamlined and efficient collection process fosters positive customer relationships.

VIII. The Financial Statements Picture

Both accounts payable and accounts receivable play a crucial role in your company’s financial statements. Accounts payable are listed as a current liability on the balance sheet, reflecting your short-term obligations. Accounts receivable are considered a current asset, representing the money you expect to collect within a year. The balance between these two accounts can impact key financial ratios like the current ratio, which measures your ability to meet short-term liabilities.

IX. FAQs

Q: What is the difference between accounts payable and accrued expenses?

A: Accrued expenses are similar to accounts payable, but they represent ongoing expenses you haven’t yet received an invoice for (e.g., accrued salaries or rent). Both are considered short-term liabilities.

Q: How can I improve my creditworthiness with vendors?

A: Maintaining a good payment history with vendors is key. Additionally, demonstrating strong financial health and providing clear communication about your business can improve your creditworthiness and potentially lead to more favorable payment terms.

Q: What happens if a customer cannot pay their outstanding invoice?

A: If a customer fails to pay after following your defined collection process, you may need to consider writing off the debt as bad debt expense. Depending on the amount and circumstances, you may also pursue legal action to recover the funds.

Q: What are some best practices for managing accounts payable and receivable?

- Implement clear policies and procedures for both AP and AR.

- Automate tasks whenever possible to streamline processes and reduce errors.

- Maintain clear communication with vendors and customers.

- Regularly monitor your AP and AR balances to ensure healthy cash flow.

X. Conclusion

Understanding and effectively managing both accounts payable and accounts receivable is essential for any business. By optimizing these processes, you can ensure financial stability, strong relationships with vendors and customers, and a healthy flow of cash to support your business goals.

Resources

The Institute of Internal Auditors

- Internal Controls for Accounts Payable

The National Federation of Independent Business

- Managing Accounts Receivable

- Understanding the Difference Between Accounts Payable and Accounts Receivable

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.