Master the Numbers: How To Read & Analyze The Balance Sheet Like a Pro

September 24, 2024

Grow Your Business Faster by Mastering Assets, Liabilities, and Equity

October 8, 2024Running a business involves many crucial tasks, and accounting is one of the most important aspects that you cannot afford to overlook. Mistakes in accounting can lead to significant financial losses, penalties, and even damage to your business’s reputation. Whether you’re a small business owner, a startup, or managing a growing enterprise, staying on top of your accounting is essential to ensure financial health. Below are three accounting mistakes that you must avoid at all costs to protect your business from potential pitfalls.

Importance of Accurate Accounting

Accurate accounting is the backbone of any successful business. It provides a clear picture of your financial standing, helping you make informed decisions, manage cash flow, and meet your tax obligations. It’s not just about balancing books—it’s about ensuring the long-term sustainability of your business.

Why Precise Accounting is Essential for Businesses

Precise accounting helps businesses track their earnings and expenses efficiently. It gives management the data needed to make critical decisions, like when to invest in new equipment, hire additional staff, or cut back on unnecessary expenses.

The Role of Accounting in Decision Making

Financial statements generated through proper accounting methods serve as a roadmap for business decisions. They help business owners forecast future profits, allocate resources, and set realistic goals. Without accurate accounting, it’s almost impossible to gauge whether you’re headed in the right direction.

How Accounting Impacts Cash Flow and Financial Health

Good accounting practices ensure that your cash flow stays positive. They help you understand how much money is coming in versus going out, enabling you to plan for future expenses. In contrast, inaccurate accounting can lead to missed tax payments, costly errors, or even insolvency.

Mistake 1: Misclassifying Expenses

One of the most frequent and dangerous accounting errors is misclassifying expenses. Businesses often miscategorize expenses, which can lead to distorted financial statements, making it harder to get an accurate financial snapshot of the company.

Common Expense Categories Businesses Get Wrong

Small and medium-sized businesses often confuse operating expenses with capital expenses. For instance, equipment purchases might be mistakenly logged as an operating cost rather than a capital investment. Similarly, personal expenses of business owners may accidentally be included as business expenses, complicating tax returns and leading to possible audits.

Consequences of Misclassifying Expenses

Incorrect expense classification can result in several costly outcomes. Your tax liabilities might be higher or lower than they should be, leading to issues with tax authorities. Misclassifications can also distort the financial health of your company, making it difficult for investors, stakeholders, or creditors to trust your financial statements.

How to Ensure Proper Classification

To avoid this mistake, it’s essential to have a solid understanding of your expense categories. Clearly distinguish between costs that are operational (day-to-day running of the business) versus capital (long-term investments). Having a reliable accounting system or consulting with an accountant can help keep these categories accurate.

Correct Expense Classification Tips

Here are some practical tips to ensure your expenses are properly classified:

- Distinguish Between Capital and Operational Expenses: Capital expenses typically involve long-term investments like equipment or property, while operational expenses cover day-to-day costs like salaries and utilities.

- Track Employee Reimbursements: Properly document employee reimbursements to avoid categorizing personal costs as business expenses.

- Use Accounting Software: Modern accounting tools often come with built-in templates that can automatically classify expenses, ensuring they are recorded correctly.

Mistake 2: Ignoring Cash Flow Management

Many businesses focus on profit but forget that cash flow is just as important—if not more. While profit shows how much your business is earning, cash flow tells you how much money is available for immediate expenses. Ignoring this can lead to serious liquidity problems.

Why Cash Flow Matters More than Profits

While profits are a sign that your business is growing, a positive cash flow ensures that you can pay your bills on time. A business can be profitable on paper but still run into trouble if cash is tied up in accounts receivable or slow-moving inventory.

The Dangers of Underestimating Future Cash Needs

Businesses often fail because they don’t anticipate future cash requirements. For example, they may have outstanding invoices that won’t be paid for months, but payroll and operational expenses need to be covered now. Underestimating these gaps can quickly lead to financial trouble.

Examples of How Poor Cash Flow Can Harm a Business

Imagine a scenario where a company experiences an increase in sales but fails to manage its cash flow. Without enough liquidity, they can’t fulfill orders or pay suppliers, leading to a loss in customer trust and eventual decline in business.

How to Improve Cash Flow Management

To ensure healthy cash flow:

- Cash Flow Forecasting: Create projections that estimate future cash inflows and outflows. This can help you prepare for any shortfalls in advance.

- Maintain Positive Cash Flow: Cut down on unnecessary spending and always ensure your business has enough cash reserves to meet short-term obligations.

- Automated Cash Flow Tracking: Many accounting software solutions offer features that help you keep track of your cash flow in real-time.

Mistake 3: Inaccurate Financial Reporting

Inaccurate financial reporting is one of the most damaging accounting mistakes a business can make. Incorrect reports can lead to legal trouble, damage your business’s credibility, and create confusion among stakeholders.

How Financial Inaccuracies Occur

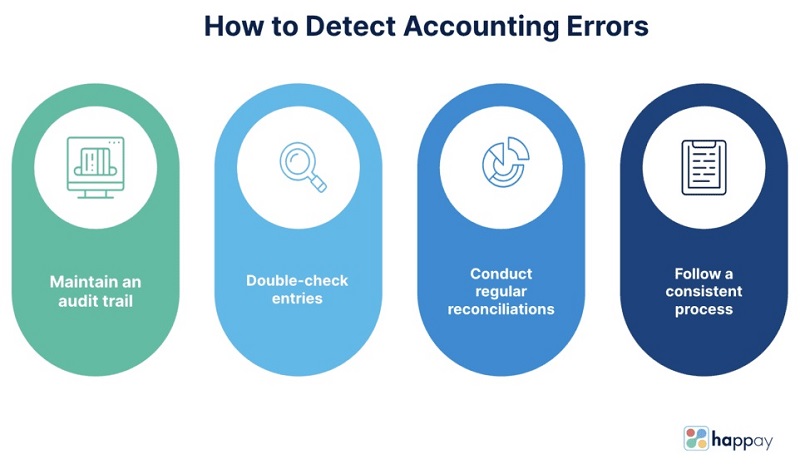

Financial inaccuracies often stem from errors in data entry, a lack of oversight, or a failure to reconcile accounts regularly. Even small mistakes can add up, resulting in reports that don’t reflect the true financial status of the business.

Legal and Business Risks of Inaccurate Reporting

From a legal perspective, inaccurate financial reporting can trigger fines, penalties, or even legal action from regulatory bodies. Internally, it can prevent management from making informed decisions, leading to bad business choices, lost profits, or an inability to secure funding.

Real-World Examples of Companies Facing Penalties Due to Bad Reporting

Major companies have faced hefty fines and lawsuits due to inaccurate financial reports. These high-profile cases highlight the importance of accurate and timely reporting in maintaining a company’s reputation and avoiding legal repercussions.

Ensuring Accurate Financial Reporting

To avoid these risks, businesses should:

- Conduct Regular Reconciliations: Reconciling bank accounts with your internal records helps catch discrepancies early.

- Hire a CPA: Professional accountants or CPAs can help ensure that your financial reports are accurate and compliant with regulatory requirements.

- Automate Financial Reporting: Tools like QuickBooks or Xero can automate reporting processes, minimizing the risk of human error.

The Ripple Effect of Accounting Mistakes

Accounting mistakes don’t just affect your finances—they can hurt your entire business. Misclassified expenses, poor cash flow management, and inaccurate reports can erode your profitability, growth, and ability to attract investors.

The Role of Technology in Avoiding Accounting Errors

Technology plays a crucial role in modern accounting. Cloud-based software, automated data entry, and financial reporting tools help prevent many common mistakes.

How Professional Accountants Can Help

Hiring a professional accountant can save your business from potential financial pitfalls. CPAs and accounting firms provide expert oversight, ensuring that your books are accurate and compliant.

Common FAQs Regarding Accounting Mistakes

Q: How can small businesses avoid these mistakes?

A: Small businesses should invest in good accounting software and consult a CPA to regularly review their finances.

Q: Are there specific tools to prevent accounting errors?

A: Yes, software like QuickBooks, Xero, and FreshBooks can automate tasks and minimize errors.

Q: What are the tax implications of misclassified expenses?

A: Misclassified expenses can lead to incorrect tax filings, resulting in audits, penalties, or lost tax deductions.

Q: How often should financial reports be reviewed?

A: Ideally, financial reports should be reviewed monthly to catch and correct mistakes early.

Q: What is the best way to track cash flow for startups?

A: Startups should use cash flow forecasting tools and keep a close eye on their accounts receivable and payable.

Q: When should a business hire a professional accountant?

A: Businesses should consider hiring an accountant when they begin scaling, or if they find it difficult to manage finances internally.

Conclusion: Staying Vigilant in Accounting Practices

Accounting is a critical part of running a business, and mistakes can be costly. By avoiding common pitfalls like misclassifying expenses, ignoring cash flow, and inaccurately reporting financials, you can ensure your business stays financially healthy and compliant.

Resources

- Accounting software solutions for small businesses

- Best practices for cash flow management

- Why you should hire a certified public accountant (CPA)

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.