Confused About Available vs. Ledger Balance? This Will Save You Money!

June 11, 2024

Don’t Let Bad Data Sink Your Business: Master These Metrics

July 25, 2024Part 1: The Foundation of Financial Tracking: Choosing an Accounting Method for Your New Business

Every new business owner understands the importance of having a solid financial foundation. Accounting methods play a crucial role in establishing this foundation by providing a framework for tracking income and expenses. Choosing the right accounting method for your business can significantly impact your ability to monitor financial health, make informed decisions, and achieve long-term success.

This first part of our guide will equip you with the knowledge to navigate the world of accounting methods. We’ll explore the two main approaches: cash-basis accounting and accrual-basis accounting. We’ll then delve into the key factors to consider when selecting the most suitable method for your specific business needs.

Introduction

Imagine running your business without a clear picture of your finances. How much money is coming in? How much are you spending? Without a proper accounting system, these essential questions become difficult to answer. Accounting methods provide a structured approach to recording financial transactions, offering a transparent view of your business’s financial performance. By diligently tracking income and expenses, you can make informed decisions about resource allocation, pricing strategies, and future growth.

Understanding the Two Main Accounting Methods

The two primary accounting methods used by businesses are:

Cash-Basis Accounting:

- This method is known for its simplicity. Transactions are recorded only when cash is physically received or paid out. For example, if you sell a product for $100 on credit, you wouldn’t record this income until you receive the $100 payment. Similarly, an expense wouldn’t be recorded until you pay the bill.

Accrual-Basis Accounting:

- This method provides a more comprehensive view of your financial health. Revenue is recorded when it is earned, regardless of when the cash is received. Expenses are recorded when they are incurred, regardless of when the bill is paid. For instance, if you sell a product for $100 on credit in July, you would record the $100 income in July, even if the customer doesn’t pay until August.

Benefits of Each Method:

-

Cash-Basis Accounting:

- Easier to understand and maintain, especially for smaller businesses.

- Requires less complex bookkeeping procedures.

-

Accrual-Basis Accounting:

- Provides a more accurate picture of your business’s financial performance.

- Essential for businesses that extend credit or have inventory.

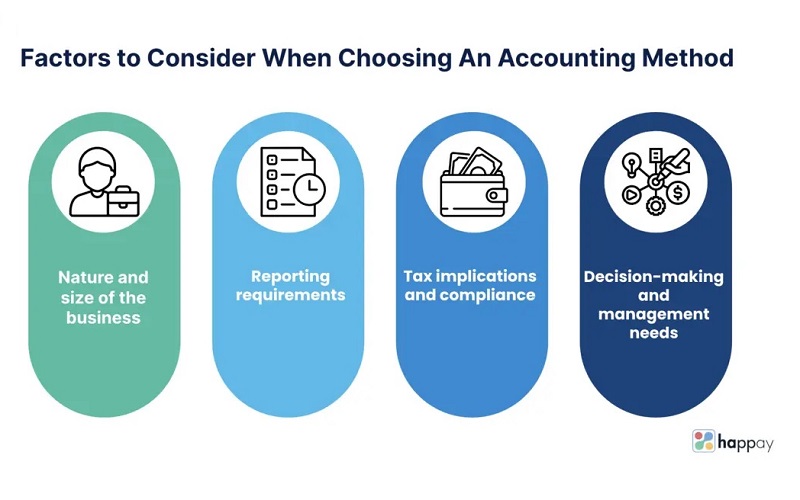

Factors to Consider When Choosing an Accounting Method

Now that you understand the core principles of cash-basis and accrual-basis accounting, let’s explore the crucial factors that will influence your choice of method:

- Business Size and Complexity

- Smaller Businesses: Cash-basis accounting can be a suitable option for smaller businesses with straightforward finances. The simplicity of recording transactions only when cash is exchanged makes it easier to manage.

- Larger Businesses: As your business grows and your financial picture becomes more complex, accrual-basis accounting becomes increasingly valuable. It provides a more accurate representation of your financial health, which is crucial for informed decision-making and attracting investors.

- Consider Future Growth: Even if your business is small currently, consider your future growth plans. If you anticipate significant expansion or the need for credit, choosing accrual-basis accounting from the outset might be a wise decision to avoid the hassle of switching methods later.

- Inventory Management

- Inventory-Based Businesses: If your business involves holding inventory, accrual-basis accounting is essential. This method allows you to accurately track the cost of goods sold (COGS), which is a vital metric for profitability analysis. Cash-basis accounting wouldn’t capture the full picture of your inventory costs.

- Service-Based Businesses: For service-based businesses with minimal inventory, cash-basis accounting might be sufficient. However, if you offer services on credit terms, accrual-basis accounting might provide a clearer picture of your outstanding receivables.

- Credit Sales and Accounts Payable

- Credit Transactions: If you extend credit to your customers or rely on credit cards for purchases, accrual-basis accounting is essential. It allows you to track outstanding accounts receivable and payable, providing a more accurate picture of your financial obligations.

- Mostly Cash Transactions: If your business primarily deals in cash transactions with minimal credit sales or purchases, cash-basis accounting might be adequate for your needs.

- Need for Accurate Financial Reporting

- Comprehensive View: Accrual-basis accounting offers a more comprehensive view of your financial health. It reflects both earned revenue and incurred expenses, even if the cash hasn’t been exchanged yet. This provides valuable insights for analyzing profitability and making informed financial decisions.

- Internal Tracking: Cash-basis accounting provides a basic level of financial tracking, which might be sufficient for internal purposes in smaller businesses that prioritize simplicity. However, it might not be suitable for external reporting or attracting investors who require a more detailed picture of your finances.

Compliance and Regulations

Beyond the factors specific to your business needs, there are external regulations to consider when choosing an accounting method:

- Generally Accepted Accounting Principles (GAAP)

- GAAP is a set of accounting standards established by the Financial Accounting Standards Board (FASB).

- Publicly traded companies and some larger businesses are required to follow GAAP for their financial reporting. GAAP typically mandates the use of accrual-basis accounting.

- Tax Regulations

-

The Internal Revenue Service (IRS) sets tax regulations that might influence your choice of accounting method. In most cases, the IRS allows businesses to choose their accounting method for tax purposes, regardless of their GAAP requirements. However, there are limitations for certain businesses, particularly those exceeding a specific annual revenue threshold. For these businesses, the IRS might mandate the use of accrual-basis accounting for tax filing.

-

Consulting a Tax Advisor: It’s crucial to consult with a qualified tax advisor to understand the specific tax implications of each accounting method for your business. They can help you navigate IRS regulations and choose the method that best aligns with your tax filing needs.

-

Part 2: Making an Informed Decision and Additional Considerations

Part 1 equipped you with the knowledge to understand the core differences between cash-basis and accrual-basis accounting, along with the key factors influencing your choice of method. Now, let’s delve into making an informed decision and explore additional considerations for new businesses.

Choosing the Right Accounting Method for Your Business

-

Recap of Key Factors: Reflect on the factors discussed in Part 1, such as your business size, complexity, inventory management, credit sales, and need for accurate financial reporting.

-

Decision-Making Framework: Consider the following questions to guide your decision:

- Simplicity vs. Comprehensiveness: Do you prioritize ease of use, or is a more detailed financial picture crucial for your business?

- Growth Plans: Are you anticipating significant growth in the future? If so, accrual-basis accounting might be a better long-term fit.

- External Reporting Needs: Do you need to generate financial reports for investors or lenders? Accrual-basis accounting is generally preferred for external reporting.

- Tax Implications: Consult with a tax advisor to understand how each method impacts your tax filing requirements.

-

Consulting a Professional Accountant: When in doubt, seeking guidance from a qualified accountant is highly recommended. They can assess your specific business needs and recommend the most suitable accounting method to ensure accurate financial tracking and compliance with regulations.

Making the Switch Between Accounting Methods

- Feasibility of Switching: Switching from cash-basis to accrual-basis accounting is generally easier than the other way around. Cash-basis accounting requires minimal adjustments when transitioning to accrual.

- Impact on Financials and Taxes: Switching methods can impact your financial statements and potentially your taxes. There might be adjustments needed to reconcile your previous records with the new method.

- Importance of Consulting an Accountant: Before making the switch, consulting with an accountant is crucial. They can guide you through the process, minimize potential disruptions, and ensure a smooth transition.

Additional Considerations for New Businesses

- Accounting Software

- Choosing the right accounting software can significantly enhance your financial management. Look for software compatible with your chosen accounting method and offering features that streamline your bookkeeping tasks.

- Popular options include QuickBooks, Xero, and FreshBooks.

- Bookkeeping Services

- Outsourcing bookkeeping tasks to a qualified professional can be a valuable investment for new businesses. This allows you to focus on core business operations while ensuring accurate financial records and timely reporting.

- Bookkeeping services are particularly helpful for complex businesses or those unfamiliar with accounting principles.

Benefits of Choosing the Right Accounting Method

Choosing the right accounting method offers a multitude of benefits for your new business, including:

- Improved Financial Tracking and Analysis: A well-chosen accounting method provides a clear picture of your financial performance, allowing you to track income and expenses effectively.

- Better Decision-Making for Growth and Profitability: With accurate financial data, you can make informed decisions about resource allocation, pricing strategies, and future investments aimed at growth and profitability.

- Easier Access to Financing and Investments: Investors and lenders often rely on financial statements to assess the financial health of a business. Using an appropriate accounting method demonstrates transparency and provides a reliable foundation for securing funding.

- Increased Confidence in Financial Reporting: Choosing the right method ensures accurate and reliable financial records, boosting your confidence in the financial data you present to investors, lenders, and other stakeholders.

FAQ

This FAQ section addresses some of the most common questions new business owners have regarding accounting methods:

-

What is the difference between cash accounting and accrual accounting?

- Cash-basis accounting records income when cash is received and expenses when cash is paid. It’s simpler but provides a less comprehensive picture of your finances.

- Accrual-basis accounting records income when it’s earned and expenses when they’re incurred, regardless of cash flow. It offers a more detailed view of your financial health but requires more complex bookkeeping.

-

Which accounting method is right for my small business?

There’s no one-size-fits-all answer. Consider these factors:

- Business Size and Complexity: Cash-basis might suffice for very small businesses with simple finances. Accrual is better for larger or complex businesses.

- Inventory: Accrual is necessary if you hold inventory.

- Credit Sales: If you extend credit, accrual provides a clearer picture of outstanding receivables.

- Need for Accurate Reporting: Accrual offers a more comprehensive view for external reporting or attracting investors.

Consulting a tax advisor is recommended to understand the tax implications of each method.

-

Can I switch accounting methods later?

Yes, but it’s generally easier to switch from cash-basis to accrual than vice versa. Switching methods can impact your financial statements and taxes. Consulting an accountant before making the switch is crucial to ensure a smooth transition.

Conclusion

Choosing the right accounting method is a crucial step in establishing a strong financial foundation for your new business. By understanding the core principles of cash-basis and accrual-basis accounting, along with the factors influencing your decision, you’re well-equipped to make an informed choice. Remember, consulting with a qualified accountant can provide invaluable guidance and ensure your chosen method aligns with your business needs and facilitates long-term success.

Resources

Choosing an Accounting Method for Your Business

- Learn more about the benefits and drawbacks of each accounting method from Score.org, a nonprofit resource for small businesses.

IRS Publication 334: Tax Guide for Small Business

- For in-depth information on IRS regulations and tax implications of accounting methods, refer to IRS Publication 334.

The Balance: Cash Basis vs. Accrual Accounting

- The Balance offers a clear comparison of cash-basis and accrual accounting for a deeper understanding.

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.