Balance Sheet vs. Profit and Loss Statement: Are You Reading Them WRONG?

August 6, 2024

Master the Numbers: How To Read & Analyze The Balance Sheet Like a Pro

September 24, 2024How to Hire a Bookkeeper

As businesses grow, the financial aspects of day-to-day operations become increasingly complex. Hiring a bookkeeper can help streamline your finances and ensure compliance with tax laws, freeing up time for you to focus on running your business. In this article, we’ll guide you through the process of hiring a bookkeeper, from understanding their role to making sure you find the right fit for your company’s needs.

Understanding the Role of a Bookkeeper

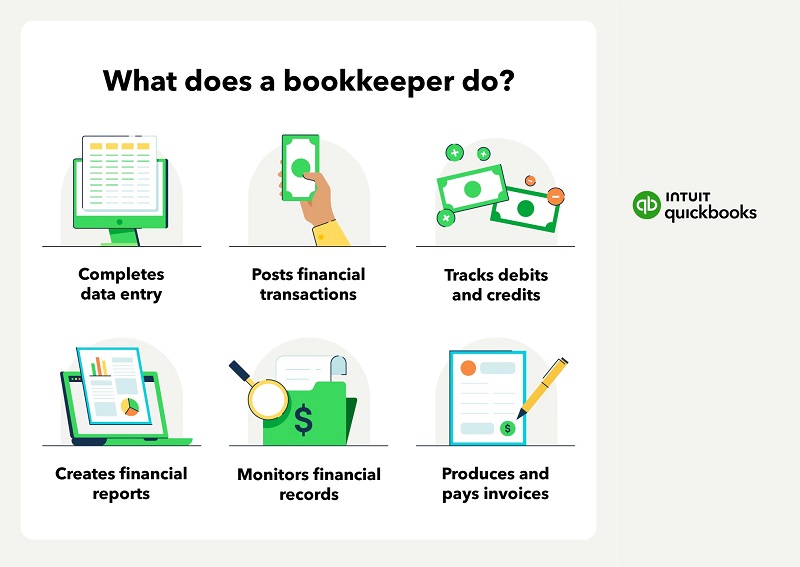

What Does a Bookkeeper Do?

A bookkeeper is responsible for managing and recording a company’s financial transactions. Their duties typically include maintaining accurate ledgers, managing accounts payable and receivable, preparing financial reports, and ensuring that tax obligations are met. By maintaining organized and accurate financial records, bookkeepers provide a clear financial picture of the business, which is crucial for decision-making and tax compliance.

Bookkeeper vs Accountant: Key Differences

While both bookkeepers and accountants work with financial information, their roles differ. Bookkeepers are tasked with the day-to-day recording of financial transactions, while accountants analyze this data and often provide broader financial advice. Accountants usually have additional certifications, such as a CPA (Certified Public Accountant), allowing them to perform tax audits, provide strategic advice, and file tax returns.

Types of Bookkeepers: Freelancers, In-House, and Virtual

When hiring a bookkeeper, you can choose between a freelancer, an in-house employee, or a virtual service. Freelancers often provide flexibility, while an in-house bookkeeper offers more immediate availability and integration into the team. Virtual bookkeepers provide remote services, which can be a cost-effective solution for small businesses.

Assessing Your Business Needs

Do You Need a Full-Time or Part-Time Bookkeeper?

The first step in hiring a bookkeeper is to assess your business’s financial needs. Small businesses with simple operations may only need part-time or freelance bookkeeping services. Larger or more complex businesses might require a full-time, in-house bookkeeper. Evaluating the volume of financial transactions, the complexity of your tax filings, and how often you need financial reports can help you decide what type of bookkeeping support is required.

Tasks and Responsibilities You Want to Delegate

Clearly outline the tasks you wish to delegate to a bookkeeper. These may include recording daily transactions, managing payroll, reconciling bank statements, preparing monthly financial reports, or handling tax compliance. Defining these responsibilities upfront helps in finding a bookkeeper with the right skills and experience.

What Financial Software Do You Use?

Bookkeepers often use specialized software to manage finances. Common programs include QuickBooks, Xero, and FreshBooks. When hiring a bookkeeper, it’s important to find someone who is proficient in the software your business already uses or is willing to learn.

Qualifications and Skills to Look For

Educational Background and Certifications

While there are no strict educational requirements for bookkeepers, many employers prefer candidates with an associate’s degree in accounting or a related field. Professional certifications such as the Certified Bookkeeper (CB) or the QuickBooks Certified User can also indicate proficiency and dedication to the profession.

Essential Bookkeeping Skills

Successful bookkeepers possess a keen eye for detail, strong organizational skills, and the ability to manage multiple tasks efficiently. In addition to technical skills like data entry and financial reporting, they must also have good communication skills to interact with clients and team members.

Knowledge of Accounting Software

Experience with accounting software is crucial. Look for candidates who are familiar with QuickBooks, Xero, FreshBooks, or other tools your company uses. In today’s digital world, bookkeepers should also be comfortable using cloud-based accounting platforms, which provide remote access to financial data.

Where to Find Qualified Bookkeepers

Freelance Platforms (Upwork, Fiverr, etc.)

Freelance websites like Upwork, Fiverr, and Freelancer offer a vast pool of experienced bookkeepers. These platforms allow you to browse profiles, read reviews from other employers, and interview candidates before making a decision. They are especially useful for businesses that need short-term or part-time bookkeeping help.

Industry-Specific Job Boards

Posting a job opening on industry-specific job boards or websites can help you find candidates with relevant experience in your sector. These platforms often attract higher-quality applicants who understand the financial nuances of your industry.

Professional Networks and Referrals

Word-of-mouth referrals can be one of the most effective ways to find a reliable bookkeeper. Ask fellow business owners or colleagues in your professional network for recommendations. Often, a referred bookkeeper comes with a proven track record, which can save you time in vetting candidates.

Hiring a Freelance Bookkeeper

Pros and Cons of Freelancers

Freelance bookkeepers offer flexibility in terms of workload and hours, which can be ideal for small businesses with irregular financial activity. However, freelancers may not be as immediately available as in-house staff, and managing them remotely requires clear communication and expectations.

Setting Clear Expectations and Deadlines

When working with a freelance bookkeeper, it’s essential to set clear expectations upfront regarding deliverables, deadlines, and communication. This can prevent misunderstandings and ensure that your financial tasks are completed on time.

Sample Contract Clauses for Freelancers

Freelance contracts should include specific details about the scope of work, payment terms, and confidentiality agreements. It’s also a good idea to include a termination clause outlining the process if either party wishes to end the contract early.

Hiring an In-House Bookkeeper

When Do You Need an In-House Bookkeeper?

An in-house bookkeeper is a good option when your business’s financial needs become too complex or frequent for a freelance or part-time bookkeeper to handle. Having someone available full-time can ensure quicker responses to financial inquiries and closer collaboration with other team members.

Full-Time vs Part-Time Employees

If you decide to hire in-house, you’ll need to choose between full-time and part-time employment. Full-time bookkeepers can handle all aspects of financial management, while part-time employees are suitable for businesses with lighter financial workloads.

Salary Expectations and Benefits

The salary of a bookkeeper depends on factors like experience, location, and the complexity of the work. In-house bookkeepers may expect benefits like health insurance, retirement plans, and paid vacation, which should be factored into your hiring budget.

Hiring a Virtual Bookkeeper

Benefits of Virtual Bookkeeping Services

Virtual bookkeepers work remotely, offering services at a lower cost than in-house staff. This is a great option for businesses that don’t require a full-time bookkeeper but still need consistent financial oversight. Virtual bookkeepers can manage your books using cloud-based software, offering flexibility and scalability as your business grows.

Ensuring Data Security and Confidentiality

When hiring a virtual bookkeeper, it’s critical to ensure that they follow stringent data security protocols. Financial data is sensitive, so make sure the bookkeeper uses secure systems for data storage and communication.

Communicating and Collaborating Remotely

Clear communication is key to a successful relationship with a virtual bookkeeper. Establish regular check-ins and reporting procedures to stay updated on your financials. Collaboration tools like Slack, Zoom, and cloud accounting software can help bridge the gap between remote and in-house teams.

Interviewing Bookkeeper Candidates

Key Questions to Ask During an Interview

When interviewing potential bookkeepers, ask about their experience with similar businesses, their familiarity with your preferred software, and how they stay current with changes in tax laws. You can also inquire about how they handle high-pressure situations, such as tax season or financial audits.

Assessing Their Work Experience

Ask candidates about specific challenges they’ve faced in previous bookkeeping roles. This can help you understand how they’ve handled complex financial situations, and whether they have the experience necessary to manage your business’s finances.

Evaluating Their Problem-Solving and Analytical Skills

Bookkeepers need to be able to identify errors, inconsistencies, or opportunities for financial improvement. During the interview, you can present hypothetical scenarios to gauge their problem-solving abilities.

Reviewing Credentials and References

Verifying Certifications

It’s important to verify the credentials and certifications of any bookkeeper you plan to hire. Certifications like the Certified Bookkeeper (CB) or membership in professional organizations like the American Institute of Professional Bookkeepers (AIPB) can demonstrate a commitment to the field.

Checking References and Previous Work

Always request references from previous clients or employers. Contact these references to inquire about the bookkeeper’s reliability, accuracy, and professionalism. It’s also a good idea to ask for samples of their work, such as financial reports or tax filings, to assess their capabilities.

Conducting Background Checks for Assurance

To ensure the security and integrity of your financial data, conducting a background check on potential hires is a smart move. This step helps confirm the candidate’s qualifications and can reveal any past legal or financial issues that may be of concern.

Setting Your Budget for Bookkeeping Services

Understanding Market Rates for Bookkeepers

Bookkeeping rates vary based on location, experience, and the type of work required. Freelance bookkeepers often charge an hourly rate, while in-house employees will expect a salary. Market research can help you determine what a reasonable rate is for the level of service you need.

Hourly vs Salary-Based Compensation

You may pay bookkeepers hourly for freelance or part-time work, while in-house employees are typically paid a fixed salary. Be sure to weigh the pros and cons of each model based on your company’s financial activity and requirements.

Hidden Costs (Software, Training, etc.)

When hiring a bookkeeper, you may encounter hidden costs, such as the purchase of bookkeeping software or the time required to train the new hire on your business’s specific processes. Factoring these costs into your budget is essential for a smooth onboarding experience.

Testing for Practical Skills

Assigning Real-World Tasks to Test Accuracy

Before making a final decision, it’s helpful to assign practical tasks that reflect the work they’ll be doing. This could include reconciling a set of accounts, preparing a financial report, or entering data into your accounting software.

Analyzing Their Familiarity with Your Industry

A bookkeeper with experience in your industry will be more familiar with the specific financial challenges and regulations you face. Testing their knowledge of industry-specific issues can ensure a smoother transition into your business.

Reviewing Financial Statements They’ve Managed

Ask candidates to provide examples of financial statements they’ve managed in the past. This can give you insight into their attention to detail, accuracy, and overall bookkeeping proficiency.

Onboarding Your New Bookkeeper

Providing Training on Internal Systems

Once you’ve hired a bookkeeper, providing thorough training on your internal systems and processes is crucial. This ensures that they understand how to use your software, follow company procedures, and meet your expectations for financial reporting.

Setting Up Software Access and Permissions

Your bookkeeper will need access to your financial software, bank accounts, and any other relevant systems. Set up secure logins and permissions to control what they can view and edit.

Establishing Regular Reporting Guidelines

Define how often you expect financial reports and what specific metrics you want to be included. Setting clear guidelines ensures that both you and your bookkeeper are aligned on the goals and timing of financial updates.

Managing the Bookkeeper-Client Relationship

Setting Expectations and KPIs

From the outset, establish key performance indicators (KPIs) for your bookkeeper. These could include timely completion of financial reports, accurate reconciliation of accounts, or meeting tax deadlines. Clear expectations help measure their success and provide a framework for evaluating performance.

Establishing Clear Communication Channels

Regular communication is key to a successful bookkeeping relationship. Set up preferred communication methods, such as email, phone, or video calls, and establish how often you expect updates on your financials.

Conducting Regular Performance Reviews

Just like any other employee or contractor, a bookkeeper’s performance should be reviewed periodically. Regular performance reviews allow you to address any concerns, give feedback, and ensure that your financial goals are being met.

Legal and Tax Considerations

Tax Implications of Hiring a Bookkeeper

Hiring a bookkeeper, especially as an employee, has tax implications for your business. Make sure you’re aware of the requirements for payroll taxes, and if you’re hiring a freelancer, ensure they are properly classified to avoid tax complications.

Ensuring Legal Compliance and Record-Keeping

A professional bookkeeper should ensure that your financial records are maintained in compliance with legal standards. This includes accurate tracking of expenses, income, and tax deductions, as well as ensuring your business is audit-ready at all times.

Contracts, Non-Disclosure Agreements, and Liability

When hiring a bookkeeper, especially a freelancer or virtual service, consider using contracts that include non-disclosure agreements (NDAs) to protect sensitive financial information. It’s also important to clarify liability in the event of errors or omissions in financial records.

Common Mistakes to Avoid When Hiring a Bookkeeper

Hiring Based on Price Alone

While cost is an important factor, hiring the cheapest bookkeeper may lead to poor service or mistakes that could cost your business more in the long run. It’s essential to prioritize experience, skills, and reputation over price.

Not Checking for Relevant Industry Experience

Different industries have unique financial needs, so hiring a bookkeeper with experience in your sector can be invaluable. Whether it’s handling payroll for a construction business or managing cash flow for a retail company, industry-specific knowledge ensures more accurate financial management.

Overlooking Security and Data Protection Measures

Financial information is sensitive, and ensuring your bookkeeper has secure processes in place to protect this data is vital. Overlooking this aspect can lead to breaches or loss of crucial information.

Conclusion

Hiring a bookkeeper is a crucial step for any business looking to streamline financial management, ensure accuracy in accounting, and stay compliant with tax regulations. Whether you choose a freelancer, in-house, or virtual service, taking the time to assess your specific needs, vet candidates thoroughly, and set clear expectations will lead to a successful and productive relationship. By following the guidelines outlined in this article, you can confidently hire a bookkeeper who will help improve your financial operations and free up your time to focus on growing your business.

Frequently Asked Questions

Q: How much does it cost to hire a bookkeeper?

A: The cost varies depending on whether you hire a freelance, in-house, or virtual bookkeeper. Freelancers typically charge $25 to $75 per hour, while in-house bookkeepers may earn $40,000 to $60,000 annually, depending on experience and location.

Q: What certifications should a bookkeeper have?

A: While not always required, certifications like Certified Bookkeeper (CB) or Certified Public Accountant (CPA) can indicate a higher level of expertise and professionalism.

Q: How do I know if I need a bookkeeper?

A: If your business has complex financial transactions, struggles with timely tax filings, or needs consistent financial reports, hiring a bookkeeper can improve financial accuracy and reduce your administrative burden.

Q: Can I hire a part-time or virtual bookkeeper?

A: Yes, part-time or virtual bookkeepers are a flexible and cost-effective solution for businesses that don’t require full-time bookkeeping services.

Q: What’s the difference between a bookkeeper and an accountant?

A: Bookkeepers handle day-to-day financial tasks, while accountants provide broader financial analysis and advice. Accountants often have certifications that allow them to conduct audits and file taxes.

Q: How do I ensure my financial data is secure with a bookkeeper?

A: Ensure your bookkeeper uses secure software, follows best practices for data protection, and signs a non-disclosure agreement to safeguard your financial information.

Resources

QuickBooks Online Bookkeeping Software

- Link to QuickBooks, one of the most popular accounting and bookkeeping software, useful for businesses considering software for their bookkeeping needs.

AIPB Certified Bookkeeper Program

- A link to the American Institute of Professional Bookkeepers (AIPB) certification page, relevant for readers looking to verify bookkeeper credentials or pursue certification.

Guide to Freelancing on Upwork

- This Upwork resource explains how freelancing works, which is valuable for those considering hiring freelance bookkeepers from the platform.

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.