Essential Questions to Ask An Accountant for a Thriving Financial Future

March 6, 2024

Your Accounting Nightmare Ends Here: The HIDDEN Advantages of a Balanced Trial Balance

March 22, 2024Why Small Business Owners Should Be Using an Accountant for More Than Taxes

Running a small business is an exhilarating journey filled with challenges and rewards. From developing innovative products to managing day-to-day operations, small business owners wear many hats. One crucial area that often gets squeezed for time is financial management.

Many entrepreneurs see accountants solely as tax preparers who swoop in once a year to handle tax filings. However, this limited view overlooks the immense value a qualified accountant can bring to your small business. By leveraging an accountant’s expertise beyond tax preparation, you can gain significant advantages in financial management, planning, and growth.

This article explores the expanded role accountants can play in your small business success. We’ll delve into the services offered by accountants that extend far beyond tax filing, and highlight the numerous benefits you can reap by establishing a strong relationship with a financial professional.

Beyond Tax Preparation: The Expanded Role of Accountants for Small Businesses

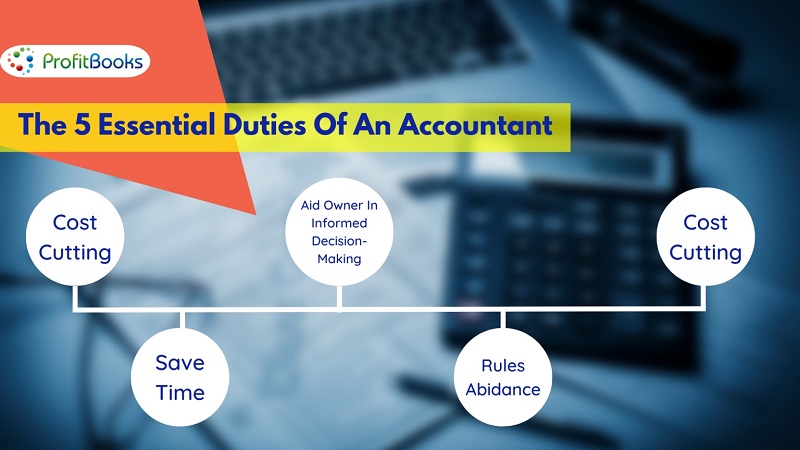

While tax preparation is undoubtedly an important service, it’s just the tip of the iceberg when it comes to what an accountant can do for your small business. Here’s a breakdown of how accountants can become valuable partners in your financial journey:

-

Accountant vs. Bookkeeper: It’s important to distinguish between accountants and bookkeepers. Bookkeepers handle the day-to-day recording of financial transactions, while accountants analyze this data, generate reports, and provide strategic financial advice. Both roles are crucial for maintaining accurate financial records, but they serve distinct functions that often complement each other.

-

Services Offered by Accountants Beyond Tax Filing: Accountants offer a comprehensive suite of services that can empower you to make informed financial decisions and navigate the complexities of business ownership. Let’s explore some key areas:

- Bookkeeping & Financial Recordkeeping: Accurate financial records are the foundation for effective financial management. Accountants can help you set up a robust bookkeeping system, ensuring your financial data is organized and readily available for analysis.

- Financial Analysis & Reporting: Understanding your business’s financial health is essential for making informed decisions. Accountants can analyze your financial statements, identify key metrics like profitability and cash flow, and generate reports that provide valuable insights into your business performance.

- Budgeting & Forecasting: Financial planning is vital for ensuring the long-term stability and growth of your business. Accountants can assist you in creating realistic budgets and developing financial forecasts to predict future performance and make informed investment decisions.

Benefits of Utilizing an Accountant for More Than Tax Services

The advantages of working with an accountant extend far beyond simply ensuring accurate tax filings. Here are some key benefits that can significantly enhance your small business journey:

-

Financial Peace of Mind:

- Reduced Stress and Errors: Managing finances can be a time-consuming and stressful task. Accountants can handle the complexities of bookkeeping and tax preparation, freeing you to focus on core business activities.

- Confidence in the Accuracy of Tax Filings: Tax laws can be intricate and ever-changing. Having a qualified accountant ensures your taxes are filed accurately and efficiently, minimizing the risk of errors and potential penalties.

-

Improved Financial Decision-Making:

- Data-Driven Insights: Financial data is the lifeblood of any business. Accountants can analyze your financial records and translate them into actionable insights you can use to optimize your business strategies.

- Identification of Cost-Saving Opportunities: By analyzing your spending patterns, an accountant can identify areas where you can optimize your finances and reduce unnecessary expenses.

-

Strategic Business Planning:

- Development of Long-Term Financial Goals: Having a clear financial roadmap is essential for steering your business towards success. Accountants can work with you to establish realistic financial goals and develop strategies to achieve them.

- Support in Achieving Business Growth Objectives: Whether you’re planning to expand your product line or enter new markets, an accountant can provide guidance and support to ensure your business has the financial resources needed for growth.

-

Enhanced Compliance & Risk Management:

- Minimizing the Risk of Audits and Penalties: Navigating tax regulations can be a complex task. Accountants stay up-to-date on the latest tax laws and ensure your business adheres to all compliance requirements, significantly reducing the risk of audits and potential penalties.

- Ensuring Adherence to Tax Regulations and Legal Requirements: Operating within the legal framework is crucial for any business. Accountants can help you stay compliant with all tax regulations and legal requirements, protecting your business from potential liabilities.

-

Access to Specialized Expertise:

- Accountants with Industry-Specific Knowledge: Many accountants specialize in specific industries. Leveraging the expertise of an accountant who understands the unique financial challenges of your industry can be invaluable.

- Guidance on Complex Financial Matters: As your business grows, you may encounter complex financial situations. Accountants can provide expert guidance and support to navigate these challenges and develop sound financial strategies.

Part 2: Partnering with an Accountant for Success

Now that we’ve established the value proposition of working with an accountant beyond tax season, let’s explore the practical steps involved in finding the right financial partner for your small business.

How to Find the Right Accountant for Your Small Business

Choosing the right accountant is a crucial decision that can significantly impact your business’s financial health. Here are some key factors to consider during your search:

-

Qualifications & Experience:

- Relevant Certifications (CPA, CMA): Look for an accountant with relevant professional certifications, such as Certified Public Accountant (CPA) or Certified Management Accountant (CMA). These certifications demonstrate expertise in accounting principles and ethical practices.

- Experience Working with Small Businesses in Your Industry: Experience working with businesses in your specific industry is highly beneficial. An accountant familiar with the financial challenges and opportunities unique to your industry can provide more tailored guidance.

-

Services Offered:

- Matching Your Business Needs with the Accountant’s Service Portfolio: Ensure the accountant offers the specific services you require. Do you need bookkeeping assistance, tax planning expertise, or help with budgeting and forecasting? Choose an accountant whose service portfolio aligns with your current and future business needs.

-

Communication Style & Personality:

- Finding an Accountant You Feel Comfortable Working With: Building a strong working relationship with your accountant is essential. Choose someone you feel comfortable communicating with openly and someone who can explain complex financial concepts in a clear and understandable way.

-

Fees & Billing Structure:

- Transparency in Pricing and Billing Options: Be upfront about your budget and inquire about the accountant’s fees and billing structure. Some accountants charge hourly rates, while others offer fixed monthly retainers. Transparency in pricing allows you to choose an option that aligns with your financial resources.

Finding the Right Accountant: Consider utilizing resources like the National Association of Certified Public Accountants (AICPA) website to find qualified professionals in your area. Professional organizations often offer directories with search filters based on location, specialization, and service offerings.

Networking: Talk to other small business owners in your network and ask for recommendations for accountants they trust. Word-of-mouth referrals can be a valuable way to identify reputable professionals.

Initial Consultations: Schedule initial consultations with a few shortlisted accountants. This provides an opportunity to discuss your business needs, get a sense of their communication style, and inquire about their fees.

Building a Strong Relationship with Your Accountant

Once you’ve found the right accountant, the next step is fostering a collaborative and productive working relationship. Here are some key tips:

-

Open Communication & Information Sharing:

-

Providing Your Accountant with All Necessary Financial Information: The more information your accountant has about your business finances, the better equipped they are to provide tailored advice and support. Provide them with all relevant financial documents, including bank statements, invoices, and receipts.

-

Maintaining Regular Communication about Business Goals and Challenges: Keep your accountant informed about your business goals, challenges, and upcoming milestones. This ongoing communication allows them to proactively address your needs and provide strategic financial guidance.

-

-

Scheduled Meetings & Reviews:

-

Establishing a Regular Meeting Schedule for Financial Updates and Discussions: Schedule regular meetings with your accountant to discuss your financial performance, review key metrics, and address any questions or concerns you may have. The frequency of meetings can vary depending on your business needs, but quarterly or biannual meetings are a good starting point.

-

Proactive Approach to Addressing Any Emerging Financial Concerns: Don’t wait for problems to arise before reaching out to your accountant. If you encounter any unexpected financial challenges or have questions about upcoming projects, proactively seek your accountant’s guidance to ensure you make informed decisions.

-

-

Collaborative Planning & Strategy Sessions:

-

Involving Your Accountant in Business Planning Discussions: Include your accountant in discussions about your business goals and strategic planning sessions. Their financial expertise can be invaluable in analyzing the financial feasibility of your plans and developing strategies to achieve sustainable growth.

-

Utilizing Their Expertise to Develop Financial Strategies Aligned with Overall Goals: Leverage your accountant’s knowledge and experience to develop sound financial strategies aligned with your overall business goals. Whether it’s creating a budget for a new product launch or developing a long-term financial plan, your accountant can be a valuable partner in your financial journey.

-

Case Studies: How Accountants Helped Small Businesses Thrive

Real-life examples can illustrate the tangible benefits of partnering with an accountant. Here are a few case studies showcasing how accountants played a crucial role in the success of small businesses:

- Case Study 1: Increased Profitability

A local bakery owner was struggling with stagnant profits despite strong customer demand. They partnered with an accountant who analyzed their financial data and identified areas of excessive spending. The accountant recommended cost-saving measures like renegotiating supplier contracts and optimizing inventory management. By implementing these recommendations, the bakery owner was able to significantly reduce expenses and increase their profit margin.

- Case Study 2: Successful Business Expansion

A clothing boutique owner with a thriving online store wanted to expand by opening a physical storefront. They collaborated with an accountant who developed a comprehensive financial plan and cash flow forecast. The accountant helped them secure a small business loan and create a detailed budget for the new location. With the accountant’s sound financial guidance, the boutique owner successfully launched their new store and achieved their expansion goals.

- Case Study 3: Avoiding an Audit

A freelance graphic designer received a complex tax notice from the IRS. Concerned about a potential audit, they hired an accountant. The accountant reviewed their financial records, identified minor filing errors, and proactively filed amended tax returns. By taking swift action and ensuring accurate tax compliance, the accountant helped the graphic designer avoid a costly audit and potential penalties.

These case studies highlight the diverse ways accountants can contribute to a small business’s success. From optimizing profitability and facilitating growth to navigating tax complexities, a qualified accountant can be a valuable asset for any small business owner.

Conclusion

By leveraging the expertise of an accountant beyond tax preparation, small business owners gain a valuable financial partner. From ensuring accurate bookkeeping and tax compliance to developing strategic financial plans and navigating complex financial challenges, an accountant can significantly impact your business’s success. We encourage you to find the right accountant for your small business and invest in a strong financial future.

FAQs

Here are some frequently asked questions (FAQs) about working with an accountant for small businesses:

Q: Can I afford an accountant for my small business?

- A: There are options for every budget. Consider exploring part-time accounting services or utilizing cloud-based accounting solutions to keep costs manageable. Remember, the long-term benefits of improved financial management and strategic guidance can significantly outweigh the initial investment.

Q: What if my business is very small and new?

- A: Establishing good financial practices from the beginning is crucial for future growth. Many resources are available for new businesses, such as SCORE mentors or Small Business Administration (SBA) programs. These resources can offer guidance on bookkeeping basics and connect you with affordable accounting services.

Q: How often should I meet with my accountant?

- A: A minimum of quarterly or biannual meetings is recommended for financial updates and discussions. Schedule additional meetings as needed for strategic planning, tax discussions, or addressing any emerging financial concerns.

Resources

Service Corp of Retired Executives

- SCORE can help you start, grow or successfully exit a business.

Small Business Administration (SBA)

- Guide to Starting a Business

National Association of Certified Public Accountants (AICPA)

- The global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.