Small Businesses: You’re Probably MISSING OUT on These HUGE Tax Write-Offs!

April 11, 2024

PNL in Business: The One Chart You Need to See to Make Money Flow

April 25, 2024Demystifying Financial Statements

Financial statements are the cornerstone of understanding a business’s financial health. They act as a clear and concise report card, presenting a company’s financial performance and position at a specific point in time. Regardless of your role in a business, from entrepreneur to investor, familiarizing yourself with financial statements is crucial for informed decision-making.

What are Financial Statements?

Financial statements are formal documents that summarize a company’s financial activities and overall financial health. They provide a standardized and transparent way to communicate a company’s:

- Profitability: How much money a business earns after expenses.

- Solvency: A company’s ability to meet its financial obligations.

- Liquidity: How easily a business can convert assets into cash.

These statements are essential for various stakeholders, including:

- Investors: To assess the risk and potential return on investment.

- Creditors: To evaluate the company’s ability to repay loans.

- Management: To track performance, identify financial strengths and weaknesses, and make strategic decisions.

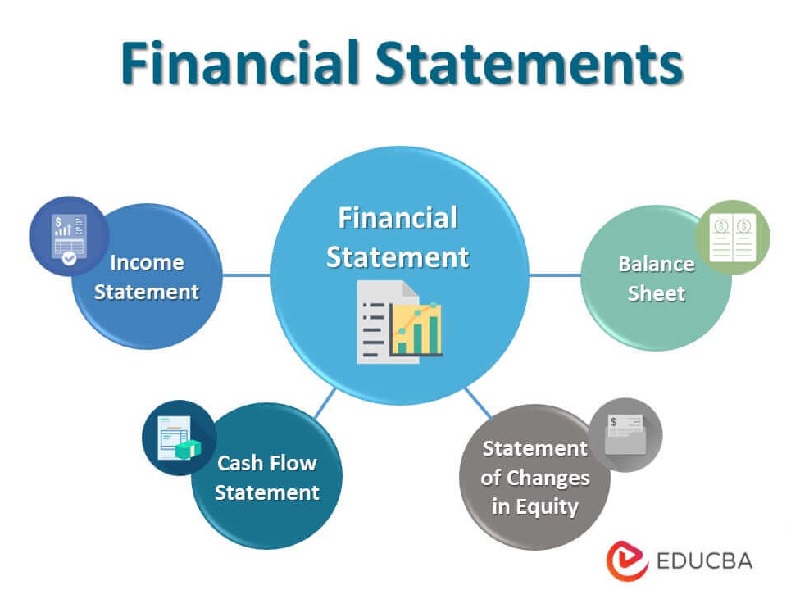

The Three Main Types of Financial Statements

There are three main types of financial statements, each serving a specific purpose:

- Income Statement (Income Statement): Focuses on a company’s profitability over a specific period. It details a company’s revenue, expenses, and net income (profit).

- Balance Sheet (Balance Sheet): Provides a snapshot of a company’s financial position at a specific point in time. It lists all assets (what the company owns), liabilities (what the company owes), and shareholder’s equity (the difference between assets and liabilities).

- Cash Flow Statement (Cash Flow Statement): Tracks the movement of cash in and out of a business over a period. It categorizes cash flow from operating, investing, and financing activities.

Understanding each statement’s components and how they work together is crucial for a comprehensive financial analysis.

Understanding Financial Statement Terminology

Financial statements are filled with specific terms that may seem daunting at first. However, grasping these key terms will unlock a deeper understanding of a company’s financial situation. Here are some fundamental concepts to keep in mind:

- Revenue vs. Income: Revenue is the total amount of money earned from selling goods or services. Income, also known as net income, is the profit remaining after deducting all expenses from revenue.

- Assets vs. Liabilities vs. Equity: Assets are what a company owns, such as cash, inventory, or equipment. Liabilities are what a company owes, such as accounts payable or loans. Equity represents the owners’ investment in the business (the difference between assets and liabilities).

- Current vs. Non-Current Classifications: Assets and liabilities can be further categorized as current or non-current. Current assets and liabilities are expected to be settled or used within one year. Non-current assets and liabilities have a longer-term horizon (more than one year).

By familiarizing yourself with these essential terms, you’ll be well on your way to deciphering the language of financial statements.

Building Your Financial Statements Step-by-Step

Now that you understand the significance of financial statements and their core components, let’s delve into the practical steps involved in creating them yourself.

Gathering the Information You Need

The accuracy and organization of your financial records are paramount for generating reliable financial statements. Here’s what you’ll need:

- Accurate and Organized Records: Financial statements rely on accurate data. Ensure your accounting records are meticulously maintained, with proper documentation for all transactions.

- Types of Business Records to Utilize: Depending on the size and complexity of your business, you might utilize a general ledger, a chart of accounts, and historical financial statements for reference. Many businesses also utilize accounting software to manage their financial data.

Once you have your financial data in order, we can proceed to constructing each financial statement.

Creating an Income Statement

The Income Statement paints a clear picture of your company’s profitability over a specific period (e.g., month, quarter, year). Here’s a breakdown of the key steps involved:

1. Choosing Your Reporting Period: Decide on the timeframe your Income Statement will cover.

2. Calculating Revenue: This represents the total income generated from selling goods or services.

3. Understanding Cost of Goods Sold (COGS): For businesses that sell products, COGS represents the direct costs associated with producing those goods.

4. Determining Gross Profit: This metric reveals your initial profit after subtracting COGS from revenue.

5. Accounting for Operating Expenses: These are ongoing expenses associated with running your business, such as rent, salaries, and utilities.

6. Calculating Net Income: This is the ultimate measure of your profitability, reached by subtracting all expenses from your revenue.

7. Formatting and Presenting the Income Statement: Present your income statement in a clear and concise format, categorizing revenue, expenses, and net income for easy understanding.

By following these steps and presenting the information effectively, you’ll have a solid Income Statement that showcases your company’s profitability.

Creating a Balance Sheet

The Balance Sheet provides a snapshot of your company’s financial position at a specific date. It essentially answers the question: “What does the company own (assets), owe (liabilities), and have left over (equity) on this particular day?”

1. Listing Your Assets (Current & Non-Current): Current assets are readily convertible to cash within a year (e.g., cash, inventory). Non-current assets are long-term investments (e.g., property, equipment).

2. Identifying Your Liabilities (Current & Non-Current): Current liabilities are short-term debts due within a year (e.g., accounts payable). Non-current liabilities are long-term debts (e.g., mortgages).

3. Calculating Shareholders’ Equity: Equity represents the owners’ investment in the business (total assets minus total liabilities).

4. Formatting and Presenting the Balance Sheet: Organize your Balance Sheet with assets listed on one side and liabilities & equity on the other. Ensure the total assets equal the total liabilities plus shareholder equity.

A well-formatted Balance Sheet provides a clear picture of your company’s financial health at a specific point in time.

Creating a Cash Flow Statement

The Cash Flow Statement tracks the movement of cash in and out of your business over a specific period. It categorizes cash flow into three main activities:

- Operating Activities: Cash flow generated from core business operations (e.g., sales receipts, payments to suppliers).

- Investing Activities: Cash flow associated with buying or selling long-term assets (e.g., purchasing equipment, selling property).

- Financing Activities: Cash flow related to financing the business (e.g., issuing debt, issuing or repurchasing stock).

1. The Three Categories of Cash Flow Activities: Understanding how cash flows through each category provides valuable insights into your company’s financial health.

2. Understanding How Cash Flows Through Each Category: Analyze how your operating, investing, and financing activities impact your overall cash position.

3. Formatting and Presenting the Cash Flow Statement: Categorize cash inflows and outflows for each activity, presenting a clear picture of your company’s cash flow cycle.

By creating a Cash Flow Statement, you gain valuable insights into how your business generates and utilizes cash, a crucial aspect of financial health.

Financial Statement Analysis – What the Numbers Tell You

While creating the statements themselves is important, financial statement analysis takes things a step further. Financial ratios can be used to analyze the information presented in these statements, revealing trends and providing deeper insights into a company’s performance and financial well-being.

Conclusion

Understanding and creating financial statements empowers you to make informed financial decisions for your business. Whether you’re a seasoned entrepreneur or just starting out, familiarizing yourself with these financial tools is crucial for success. Remember, accurate and well-presented financial statements are not only valuable for internal analysis but also play a significant role in attracting investors, securing loans, and fostering trust with stakeholders.

FAQs (Frequently Asked Questions)

Here are some commonly asked questions regarding creating financial statements:

- Do I need a financial professional to create financial statements?

For small businesses with straightforward financial records, creating basic financial statements may be manageable. However, for complex businesses or those requiring in-depth analysis, consulting with a qualified accountant or financial professional is highly recommended.

- What software can I use to create financial statements?

Many accounting software programs offer features to streamline the creation of financial statements. Popular options include QuickBooks, Xero, and FreshBooks. These programs can automate calculations, generate reports, and ensure consistency in your financial data.

- How often should I create financial statements?

The frequency of creating financial statements depends on your business needs. It’s generally recommended to create them at least quarterly, with a comprehensive annual statement. More frequent statements may be beneficial for businesses with rapid growth or volatile cash flow.

- What are some common mistakes when creating financial statements?

Here are some common pitfalls to avoid:

- Inaccurate Data Entry: Ensure all transactions are accurately recorded and categorized in your accounting system.

- Improper Classification: Distinguish between current and non-current assets and liabilities correctly.

- Missing Information: Include all necessary details and disclosures in your statements.

- Inconsistent Formatting: Maintain a consistent format across all your financial statements for clear presentation.

By following best practices and addressing these common mistakes, you can ensure your financial statements are accurate and reliable.

Resources

- The Importance of Financial Statements for Small Businesses

Financial Accounting Standards Board

- FASB Accounting Standards

Harvard Business School Online

- How to Prepare an Income Statement

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.