The Cheat Sheet Every Small Business Owner Needs: 7 Powerful Accounting Formulas for Financial Success

February 7, 2024

Is Your Small Business Struggling? 5 Reasons Why an Accountant Can Help

February 27, 2024Part 1: Understanding Owner’s Draws and Payroll Salaries

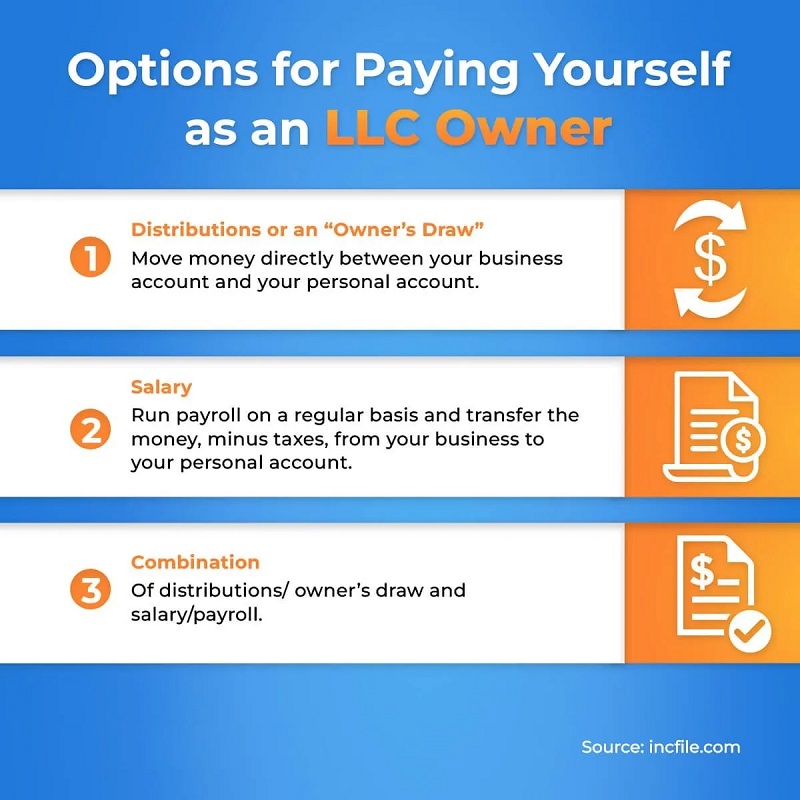

Choosing the right way to compensate yourself as a business owner can be a confusing, yet crucial, decision. Balancing flexibility, income stability, and tax implications all play a role, and understanding the key differences between owner’s draws and payroll salaries is essential. This article serves as your comprehensive guide to navigating these two compensation methods, empowering you to make an informed choice for your business and personal finances.

Demystifying the Options: Owner’s Draws vs. Payroll Salaries

-

Owner’s Draw: Essentially, taking money out of your business for personal use. It’s not a fixed amount and isn’t tied to specific hours worked. Think of it as drawing from your own equity in the business.

-

Payroll Salary: Similar to any employee, you pay yourself a regular, fixed amount as outlined in a formal payroll system. This usually requires setting up a separate business entity, like an LLC or S Corp.

Diving Deeper: The Advantages and Disadvantages of Owner’s Draws

Flexibility reigns supreme: An owner’s draw grants you the freedom to adjust your income based on your business’s performance and personal needs. No fixed paycheck means you can take less during lean months and reward yourself more during profitable periods.

Tax benefits come into play: While not exempt from taxes, owner’s draws avoid payroll taxes like Social Security and Medicare. This translates to higher take-home pay, but remember, you’ll be responsible for self-employment tax and quarterly estimated tax payments.

Profit-driven compensation: Your income directly mirrors your business’s success. This incentivizes growth and responsible financial management, as your well-being is tied to the company’s performance.

But it’s not all sunshine and rainbows:

Unpredictability lurks: Unlike a steady paycheck, owner’s draws offer no guaranteed income. This can make budgeting and financial planning challenging, especially when your business is young or unstable.

Discipline is key: The freedom to take funds at will requires self-control. Not budgeting properly can lead to overspending and hinder your business’s growth.

Tax responsibilities demand attention: While avoiding payroll taxes, you’ll need to stay on top of quarterly estimated tax payments and self-employment tax. Consulting a tax professional is highly recommended.

The Payroll Path: Exploring the Pros and Cons of Payroll Salaries

Stability takes center stage: Receiving a fixed paycheck at regular intervals provides peace of mind and allows for easier budgeting and financial planning.

Payroll taxes, simplified: With payroll, your business automatically withholds Social Security and Medicare taxes, streamlining the process and ensuring compliance.

Employee benefits beckon: Depending on your business structure, you can qualify for health insurance, retirement plans, and other employee benefits.

However, trade-offs exist:

Less flexibility compared to draws: The fixed nature of salaries limits your ability to adjust your income based on business fluctuations.

Cost considerations: Paying yourself a salary is a fixed expense for your business, impacting profitability.

Sole proprietors beware: For sole proprietors, salaries aren’t tax-deductible, unlike owner’s draws.

Weighing the Scales: A Comparative Overview

To truly understand which method suits you best, a side-by-side comparison is crucial. This table summarizes the key differences between owner’s draws and payroll salaries:

| Feature | Owner’s Draw | Payroll Salary |

|---|---|---|

| Definition | Taking funds from your business for personal use | Fixed, regular payment like an employee |

| Flexibility | High – adjust income based on needs | Low – fixed amount |

| Payroll Taxes | None withheld | Subject to Social Security & Medicare |

| Tax Implications | Self-employment tax, quarterly estimated payments | Income tax, Social Security & Medicare (employer pays half) |

| Business Expense Deduction | No | Yes |

| Income Stability | Low | High |

| Employee Benefits | No (unless incorporated) | Yes (depending on structure) |

Remember, this table presents a general overview. Consult with a tax advisor or accountant for personalized guidance.

Part 2: Making the Right Choice: Navigating Owner’s Draws vs. Payroll Salaries

Now that you understand the fundamentals of both owner’s draws and payroll salaries, the crucial question remains: Which method is right for you and your business? This section empowers you to navigate this decision by considering key factors and seeking professional guidance.

Charting Your Course: Choosing the Right Compensation Method

Several crucial factors come into play when determining the most suitable compensation strategy. Carefully consider these aspects before making your decision:

-

Business Type and Structure:

- Sole Proprietorship: Owner’s draws are your only option.

- LLC and S Corp: Both draws and salaries are possible, impacting taxes and benefits.

- C Corp: Salaries are standard, offering employee benefits but different tax implications.

-

Profitability and Cash Flow:

- Stable, predictable income: Payroll salaries may be ideal for consistent income and budgeting.

- Fluctuating income: Owner’s draws offer flexibility to adjust income based on profitability.

-

Tax Implications:

- Owner’s Draws: Self-employment tax and estimated tax payments, but potential tax savings by reducing taxable income.

- Payroll Salaries: Subject to income tax, Social Security, and Medicare, but employer pays half and salary is deductible.

-

Desired Income Stability:

- Fixed, predictable income: Opt for payroll salaries for budgeting and financial planning.

- Flexibility based on performance: Owner’s draws cater to adapting income to your business’s success.

-

Benefits Needs:

- Health insurance, retirement plans: Consider payroll salaries in eligible business structures like S Corps.

- Limited benefits: Owner’s draws might necessitate exploring individual plans for health insurance etc.

Remember, this is not an exhaustive list. Consulting with a tax advisor or accountant is highly recommended to understand the specific ramifications of each option based on your unique circumstances.

Unveiling the Tax Maze: A Deep Dive into Tax Implications

Taxes are an inevitable part of the equation, and understanding how owner’s draws and payroll salaries impact your tax burden is crucial.

-

Owner’s Draws:

- Treated as self-employment income subject to both income tax and self-employment tax.

- Quarterly estimated tax payments required to avoid penalties.

- Deductible business expenses can reduce your taxable income, potentially minimizing tax liability.

-

Payroll Salaries:

- Subject to income tax, Social Security, and Medicare taxes.

- Employer pays half of Social Security and Medicare taxes, reducing your out-of-pocket cost.

- Salary itself is a deductible business expense.

Remember, tax laws can be complex, and consulting with a tax professional is essential to ensure you’re complying with all regulations and optimizing your tax strategy.

Your Questions Answered: FAQs on Owner’s Draws and Payroll Salaries

Here are some of the most frequently asked questions regarding owner’s draws and payroll salaries:

-

Q: Can I use both owner’s draws and payroll salaries?

- A: In some cases, yes, but consult with an accountant to understand the implications for your specific business structure and tax situation.

-

Q: How often should I take an owner’s draw?

- A: There’s no set rule, but consider your personal needs, business finances, and tax implications.

-

Q: What documentation do I need for owner’s draws?

- A: Maintain clear records of all draws, including dates, amounts, and purposes. Consult with an accountant for specific recommendations.

-

Q: How do I calculate quarterly estimated tax payments?

- A: The IRS website provides guidance and tools, but a tax professional can ensure accurate calculations.

-

Q: What are the benefits of incorporating my business?

- A: Potential tax benefits, limited liability protection, and access to employee benefits are some key advantages. However, legal and administrative complexities exist.

Remember, this is not a substitute for professional advice. Seek guidance from an accountant or tax advisor to address your specific questions and concerns to make informed decisions for your business finances.

By carefully considering the factors discussed in this article and seeking professional guidance, you can confidently choose the compensation method that best aligns with your personal needs and business goals.

Stay informed and empowered on your entrepreneurial journey!

Resources

IRS Self-Employment Tax Information

- Learn more about self-employment tax from the IRS, the official source of information.

SBA Guide to Choosing a Business Structure

- Explore different business structures and their impact on compensation methods with the SBA guide.

Nolo’s Legal Encyclopedia: Owner’s Draws vs. Salaries

- Gain insights on legal considerations and detailed comparisons of owner’s draws and salaries from Nolo’s legal resources.