Why You’re Doing It Wrong: How to Hire a Bookkeeper That Fits Your Needs

September 20, 2024

3 Accounting Mistakes You Can’t Afford to Make

October 1, 2024How To Read and Analyze The Balance Sheet

Introduction to Balance Sheets

A balance sheet is a fundamental financial statement that provides a snapshot of a company’s financial position at a specific point in time. It details the company’s assets, liabilities, and equity, helping stakeholders understand its financial health. The balance sheet is often referred to as the “statement of financial position” and is one of the key reports used by investors, creditors, and business owners to evaluate the overall financial condition of a company.

The primary purpose of a balance sheet is to give insights into the company’s resources (assets) and obligations (liabilities), as well as the net worth or equity. By analyzing these elements, stakeholders can determine the company’s liquidity, debt levels, and the owner’s investment in the business. A properly analyzed balance sheet can reveal important financial indicators that influence investment and lending decisions.

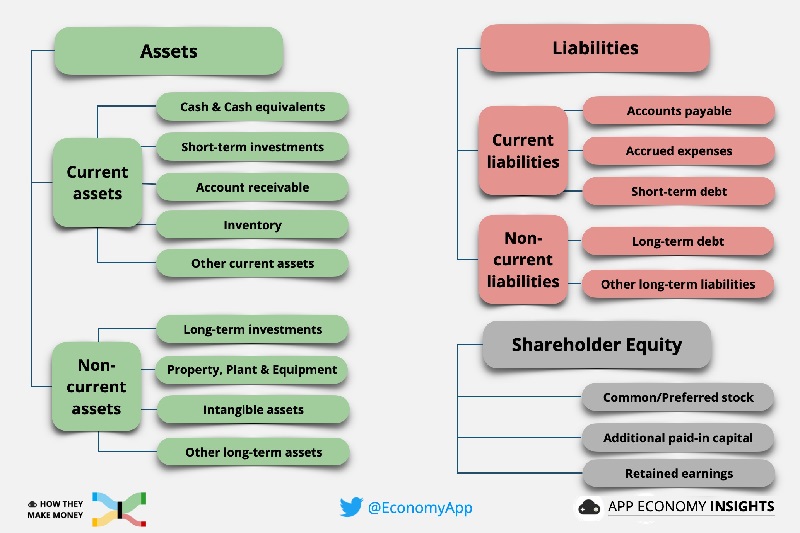

Key Components of the Balance Sheet

The balance sheet follows a fundamental equation:

Assets = Liabilities + Equity

This equation ensures that a company’s resources are always balanced against the claims on those resources, either by creditors (liabilities) or owners (equity).

- Assets: What the company owns (e.g., cash, inventory, property).

- Liabilities: What the company owes (e.g., loans, accounts payable).

- Shareholder’s Equity: The owner’s claim after all debts are paid.

Each component plays a crucial role in understanding the financial dynamics of the business.

The Structure of a Balance Sheet

A balance sheet is typically divided into two parts:

- Assets on one side.

- Liabilities and Shareholder’s Equity on the other.

There are two main formats for presenting a balance sheet:

- Vertical Format: Lists all assets first, followed by liabilities and equity.

- Horizontal Format: Assets are on the left side, while liabilities and equity are on the right.

While the format may vary, the underlying equation remains the same, ensuring that total assets always equal the sum of liabilities and equity.

Understanding Assets

Assets are the resources a company owns and expects to use to generate future economic benefits. Assets are categorized into:

- Current Assets: Assets that can be converted into cash within one year, such as cash, accounts receivable, and inventory.

- Non-Current Assets: Long-term investments that will provide value for more than a year, such as property, plant, and equipment (PP&E), and intangible assets like patents.

Understanding the types and values of assets is critical for determining a company’s ability to meet short-term obligations and its overall financial strength.

Analyzing Liabilities

Liabilities represent the obligations a company owes to outsiders. These obligations can be either:

- Current Liabilities: Debts that must be settled within one year, like accounts payable or short-term loans.

- Long-Term Liabilities: Obligations due after one year, including long-term debt, bonds payable, or lease obligations.

A company’s liabilities indicate its financial obligations and the degree to which it relies on borrowed capital to finance its operations. High levels of liabilities may signal financial instability if not properly managed.

Equity and Its Role in the Balance Sheet

Equity represents the owners’ residual interest in the company after all liabilities have been settled. In other words, equity is the difference between total assets and total liabilities. Equity consists of:

- Retained Earnings: Profits that have been reinvested in the company rather than distributed to shareholders.

- Shareholder’s Equity: Funds contributed by the company’s owners through the purchase of shares.

Equity reflects the financial health and growth potential of a business, making it an essential component of any balance sheet analysis.

How Assets Are Valued on the Balance Sheet

The valuation of assets on the balance sheet is often based on historical cost, which is the original purchase price of the asset. However, certain assets, particularly financial assets or investments, may be adjusted to reflect their fair market value. Key factors in asset valuation include:

- Depreciation: Systematic reduction in the value of tangible assets over time, like machinery or buildings.

- Amortization: The gradual write-off of intangible assets like patents or goodwill.

- Impairments: When an asset’s market value drops significantly below its carrying amount, an impairment loss is recorded.

These adjustments ensure that the balance sheet reflects the most accurate value of a company’s assets.

Liabilities: Measuring Debt and Obligations

Liabilities can be broken down into interest-bearing liabilities (like loans) and non-interest-bearing liabilities (such as accounts payable). A company’s ability to meet its debt obligations is crucial for its financial stability.

- Interest-Bearing Liabilities: These create ongoing costs for the company, making it essential to track interest payments and principal repayment schedules.

- Contingent Liabilities: Potential liabilities that depend on future events, like legal disputes or warranties.

Managing and monitoring liabilities helps ensure that a company maintains its financial health and avoids solvency issues.

Working Capital Analysis

Working capital, calculated as:

Working Capital = Current Assets- Current Liabilities

Measures a company’s short-term financial health and its efficiency in managing day-to-day operations. Positive working capital indicates that a company can pay off its short-term liabilities with its current assets. It’s a key metric used by investors and creditors to assess liquidity.

Financial Ratios Derived from the Balance Sheet

Balance sheets provide the foundation for several important financial ratios:

- Current Ratio:

Current Assets/Current Liabilities

measures a company’s ability to pay short-term obligations.

- Debt-to-Equity Ratio:

Total Liabilities/Shareholder’s Equity

assesses a company’s financial leverage and risk.

- Return on Equity (ROE):

Net Income/Shareholder’s Equity

evaluates how efficiently a company uses shareholders’ funds to generate profits.

These ratios help in comparing the financial health of companies within the same industry.

Balance Sheet Trends Over Time

Analyzing balance sheets across different time periods is essential for identifying trends in a company’s financial performance. Investors often compare the current balance sheet with those from previous years to detect:

- Growth in assets: Indicates a company’s expansion.

- Rising liabilities: May signal increasing debt or expansion through borrowed funds.

- Changes in equity: Reflects profitability, reinvestment strategies, or share buybacks.

Trend analysis helps forecast future financial health and growth potential.

Common Balance Sheet Misconceptions

There are several common misconceptions when interpreting balance sheets, including:

- Overestimating liquidity: Current assets like inventory may not always be quickly converted to cash.

- Ignoring liabilities: Failing to recognize long-term liabilities, such as pension obligations or off-balance-sheet items.

Avoiding these pitfalls is crucial for a more accurate analysis.

Red Flags in a Balance Sheet

Certain red flags in a balance sheet may indicate financial trouble, including:

- High levels of debt: Can suggest a risky level of leverage.

- Declining equity: May point to operational losses or poor financial management.

- High intangible assets: Can mask the true financial health if not backed by solid cash flows.

Recognizing these warning signs is critical for investors and creditors.

Balance Sheet Comparison Across Industries

Different industries have unique balance sheet structures. For example:

- Asset-heavy industries: Like manufacturing, often have significant investments in property and equipment.

- Service-based industries: Typically have lower fixed assets but may have higher accounts receivable.

Understanding these differences is crucial for proper comparison and evaluation.

The Role of Auditors and Standards in Balance Sheets

Balance sheets are prepared according to accounting standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). External auditors play a critical role in ensuring the accuracy and integrity of financial statements, giving confidence to investors and regulators.

How to Use a Balance Sheet for Decision-Making

Stakeholders use balance sheets for various decisions:

- Investors: Look at balance sheets to assess the financial stability and growth potential.

- Lenders: Analyze balance sheets to gauge a company’s ability to repay loans.

- Business Owners: Use balance sheets to track operational performance and plan for future growth.

Each group uses the balance sheet differently but always focuses on understanding the company’s financial position.

Frequently Asked Questions

Q: How do you spot financial strength in a balance sheet?

A: Look for a strong current ratio, low debt-to-equity ratio, and consistent growth in equity over time.

Q: What’s the difference between current and non-current liabilities?

A: Current liabilities are due within one year, while non-current liabilities are obligations payable over a longer period.

Q: Can a company operate without equity?

A: In theory, yes, but it’s rare. A company without equity is heavily financed through debt, which is a risky strategy.

Q: Why do assets and liabilities have to balance?

A: Because the balance sheet is a snapshot of the company’s financial position, every dollar of assets must be financed either by liabilities or equity.

Q: How do balance sheets differ from income statements?

A: A balance sheet shows a company’s financial position at a specific point in time, while an income statement shows its performance over a period of time.

Q: What are intangible assets on a balance sheet?

A: Intangible assets include non-physical items such as patents, trademarks, and goodwill, which have value to the business.

Resources

Understanding GAAP Accounting Standards

- Provides readers with an understanding of the accounting standards used in preparing balance sheets.

How to Calculate Key Financial Ratios

- Dive deeper into financial ratios derived from balance sheet data.

The Role of Auditors in Financial Reporting

- Explains the importance of auditors and their role in verifying the accuracy of balance sheets.

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.