Unlocking Hidden Value: Why Small Businesses Need Accountants Beyond Tax Season

March 14, 2024

Debits vs. Credits: Don’t Let This Accounting Error DRAIN Your Profits!

March 29, 2024The Power of Balance: Unveiling the Hidden Advantages of a Balanced Trial Balance

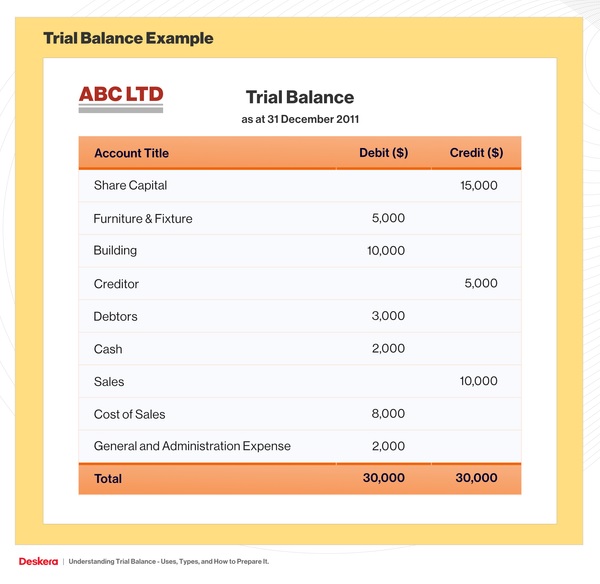

In the world of accounting, the trial balance plays a critical role. It’s a fundamental tool that summarizes the financial transactions of a business during a specific period. But beyond its basic function of ensuring debits and credits equal, a balanced trial balance holds hidden advantages that can significantly strengthen your financial foundation. This article delves into these hidden advantages, making the case for why mastering the trial balance is essential for business owners, bookkeepers, and accounting students alike.

Beyond Error Detection: The Core Function of a Trial Balance

The primary purpose of a trial balance is to verify that the total debits in your accounting system match the total credits. This seemingly simple check acts as a powerful clerical error detection mechanism. Imagine a scenario where you’ve diligently recorded numerous transactions throughout a month. A balanced trial balance assures you that these transactions haven’t been accidentally entered twice or with incorrect amounts.

Key takeaway: A balanced trial balance helps identify math errors and missing entries in your accounting records.

For example, consider a situation where you’ve mistakenly entered a purchase of office supplies for $100 twice as a debit in the “Supplies Expense” account. A balanced trial balance wouldn’t be achieved, prompting you to investigate the discrepancy and rectify the error.

While error detection is crucial, a balanced trial balance offers far more than meets the eye. Let’s delve deeper into the hidden advantages that emerge from achieving this perfect balance.

The Hidden Advantages Emerge: Strengthening Your Financial Foundation

A balanced trial balance goes beyond simply identifying errors. It unlocks a treasure trove of hidden benefits that contribute to a robust financial foundation for your business. Here, we explore some of these key advantages:

The Hidden Advantage: Enhanced Data Integrity

A balanced trial balance acts as a strong indicator of the completeness of your accounting records. When debits and credits align perfectly, it suggests that all financial transactions have been properly recorded and accounted for. This translates to a higher level of data integrity, meaning the information reflected in your financial statements is accurate and reliable. Reliable financial data is essential for making informed business decisions, such as resource allocation, investment opportunities, and pricing strategies.

Key takeaway: A balanced trial balance fosters confidence in the accuracy of your financial data, leading to better decision-making.

The Hidden Advantage: Streamlined Financial Reporting

The preparation of financial statements, like the income statement and balance sheet, relies heavily on the information compiled in the trial balance. A balanced trial balance acts as a springboard for efficient financial reporting. Since the data has already been verified for accuracy, the process of generating financial statements becomes smoother and less time-consuming. This allows you to focus on analyzing the financial health of your business rather than spending hours reconciling discrepancies.

Key takeaway: A balanced trial balance saves you valuable time and resources during the financial reporting process.

The Hidden Advantage: Confidence in Your Numbers

Imagine presenting financial statements to stakeholders with the assurance that the underlying data is accurate. A balanced trial balance fosters a sense of confidence in the numbers you present. This confidence extends to internal decision-making as well. When you trust the accuracy of your financial information, you can make informed business choices without hesitation. Additionally, a balanced trial balance can enhance the credibility of your financial data in the eyes of external stakeholders, such as investors and creditors.

Key takeaway: A balanced trial balance builds trust in your financial data, leading to more confident internal decision-making and stronger external relationships.

The Hidden Advantage: A Stepping Stone for Further Analysis

A balanced trial balance serves as a solid foundation for deeper financial analysis. Once you’ve established the accuracy of your data, you can delve into more complex financial metrics and identify trends in your business performance. This analysis can reveal valuable insights into areas like profitability, spending patterns, and areas for improvement. By leveraging a balanced trial balance, you can gain a clearer picture of your financial health and make data-driven decisions to optimize your business operations.

Key takeaway: A balanced trial balance paves the way for advanced financial analysis, enabling you to identify financial trends and optimize your business performance.

In conclusion, the benefits of a balanced trial balance extend far beyond basic error detection. It strengthens your financial foundation by ensuring data integrity, streamlining financial reporting, fostering confidence in your numbers, and laying the groundwork for deeper financial analysis. By mastering the trial balance, you gain a powerful tool to unlock the true potential of your financial data and make informed decisions that drive your business forward.

Mastering the Balance: Practical Tips and Beyond

Having explored the hidden advantages of a balanced trial balance, let’s shift our focus to practical strategies for achieving this state of perfect equilibrium. This section will equip you with the knowledge and tools to navigate the process of building and maintaining a balanced trial balance.

Building a Balanced Trial Balance: A Step-by-Step Guide

Creating a balanced trial balance is a straightforward process, but meticulous attention to detail is key. Here’s a step-by-step breakdown to guide you:

-

Ensure Accurate Account Classification: The foundation of a balanced trial balance lies in proper account classification. Double-check that your accounts are categorized accurately within the chart of accounts, whether it’s a general ledger account or a subsidiary account. Misclassified accounts can lead to discrepancies in your trial balance.

-

Record Transactions Diligently: Every financial transaction that occurs within your business needs to be meticulously recorded in the appropriate accounts. This includes purchases, sales, receipts, and payments. Maintaining accurate and complete records minimizes the risk of errors that could throw your trial balance off balance.

-

Post Entries Accurately: Once transactions are recorded, they need to be posted to the corresponding accounts in the general ledger. This involves transferring the debit and credit amounts from the journals to the respective accounts. Double-entry bookkeeping, a cornerstone of accounting, dictates that every transaction has a dual effect, recorded as a debit in one account and a credit in another. Consistent and accurate posting ensures that debits and credits balance out.

-

Reconcile Accounts Regularly: Account reconciliation involves comparing your internal account balances with external statements from third parties (e.g., bank statements, credit card statements). This process helps identify and rectify any discrepancies that might have crept into your records. Regularly reconciling accounts minimizes the chances of errors affecting your trial balance.

-

Utilize Accounting Software: Consider leveraging accounting software to streamline the process of creating and maintaining a balanced trial balance. Many software programs automate data entry, posting, and reconciliation tasks, reducing the risk of human error. Additionally, these programs often offer built-in features to identify and troubleshoot imbalances in your trial balance.

Key takeaway: Building a balanced trial balance requires a combination of accurate record-keeping, proper posting techniques, and regular account reconciliations.

Unveiling the Secrets: Common Reasons for Unbalanced Trial Balances

Even with the best intentions, imbalances can occasionally occur in your trial balance. Here are some common culprits for unbalanced trial balances:

- Math Errors: Simple typos or miscalculations when entering or transferring data can lead to imbalances.

- Missing Entries: Transactions that haven’t been recorded at all will cause inconsistencies in your trial balance.

- Posting Errors: Posting a debit or credit to the wrong account will disrupt the balance.

- Transposition Errors: Accidentally reversing digits in an amount can throw your trial balance off track.

- Omitted Signs: Forgetting to include positive or negative signs for debits and credits can result in an imbalance.

Tip: When faced with an unbalanced trial balance, don’t panic! Start by reviewing your recent transactions and postings to identify the source of the error. Utilize proofreading techniques and double-check your calculations. Accounting software often has built-in error-checking features that can pinpoint discrepancies.

Beyond the Basics: Advanced Techniques for Mastering the Trial Balance

While the fundamental steps outlined above can help you achieve a balanced trial balance, there are additional techniques that can elevate your mastery of this essential tool:

- Internal Controls: Implementing a robust system of internal controls can significantly reduce the risk of errors in your accounting processes. This includes segregation of duties, regular reviews, and clear documentation procedures. Strong internal controls contribute to the accuracy and reliability of your financial data, ultimately leading to a balanced trial balance.

- Double-Entry Bookkeeping: As mentioned earlier, double-entry bookkeeping is the bedrock of a balanced trial balance. By ensuring every transaction has a corresponding and opposite effect on two accounts, you inherently promote balance in your records.

- Understanding the Accounting Cycle: Familiarizing yourself with the complete accounting cycle, which encompasses all the steps from recording transactions to generating financial statements, provides a holistic perspective on how the trial balance fits into the bigger picture. This comprehensive understanding allows you to troubleshoot imbalances more effectively.

By mastering these advanced techniques, you can build a robust accounting system that consistently produces balanced trial balances, laying the foundation for accurate financial reporting and informed decision-making.

FAQs: Demystifying Common Questions about Trial Balances

This section addresses some frequently asked questions about trial balances, providing clear and concise answers to empower you on your journey towards mastering this valuable tool.

Q: What happens if my trial balance is unbalanced?

A: An unbalanced trial balance indicates that there’s an error somewhere in your accounting records. Don’t fret! Here’s what to do:

- Review recent transactions and postings: Look for typos, missing entries, or incorrect postings that might be causing the imbalance.

- Double-check calculations: Ensure all math is accurate, including debits and credits for each transaction.

- Utilize proofreading techniques: Carefully review your records for any discrepancies.

- Leverage accounting software: Many software programs offer error-checking features that can pinpoint imbalances.

Q: How often should I prepare a trial balance?

A: The frequency of preparing a trial balance depends on your business needs and preferences. Here are some common approaches:

- Monthly: This is a popular option, providing regular checks for accuracy and facilitating the preparation of financial statements at month-end.

- Quarterly: Less frequent than monthly, but still allows for timely identification of errors and ensures data integrity for quarterly reporting.

- Year-end: While less frequent, preparing a trial balance before year-end closing helps ensure accuracy in financial statements.

Q: What additional information can I glean from a trial balance?

A: While the primary purpose of a trial balance is to verify debits and credits match, it can offer additional insights:

- Identify accounts with high activity: A trial balance can reveal accounts with frequent transactions, potentially highlighting areas for further analysis.

- Spot potential errors: Large or unexpected balances in certain accounts might indicate underlying errors that require investigation.

- Gain a high-level overview: The trial balance provides a snapshot of your financial position at a specific point in time.

Q: How does a trial balance relate to financial statements?

A: The trial balance acts as a crucial stepping stone for generating financial statements like the income statement and balance sheet. The information compiled in the trial balance serves as the foundation for populating these statements, ensuring their accuracy reflects the overall health of your business.

By understanding these key questions and their answers, you’ll be well-equipped to navigate the world of trial balances with confidence. Remember, a balanced trial balance is a powerful tool that empowers you to make informed financial decisions for your business.

Resources

International Financial Reporting Standards (IFRS) Foundation

- Understanding the Conceptual Framework for Financial Reporting

American Institute of Certified Public Accountants (AICPA)

- The Importance of Internal Controls in Financial Reporting

- How to Prepare a Trial Balance