Your Accounting Nightmare Ends Here: The HIDDEN Advantages of a Balanced Trial Balance

March 22, 2024

From Beginner to Balance Sheet Boss: Your Crash Course to Financial Confidence

April 3, 2024Demystifying Debits and Credits in Accounting

In the world of accounting, two fundamental terms hold immense importance: debits and credits. These aren’t just random financial jargon; they form the cornerstone of the double-entry accounting system, a method for meticulously recording every financial transaction within a business.

Understanding debits and credits empowers you to decipher financial statements, track the health of your business, and ensure accurate financial reporting.

Introduction to Debits and Credits

- What are Debits and Credits in Accounting?

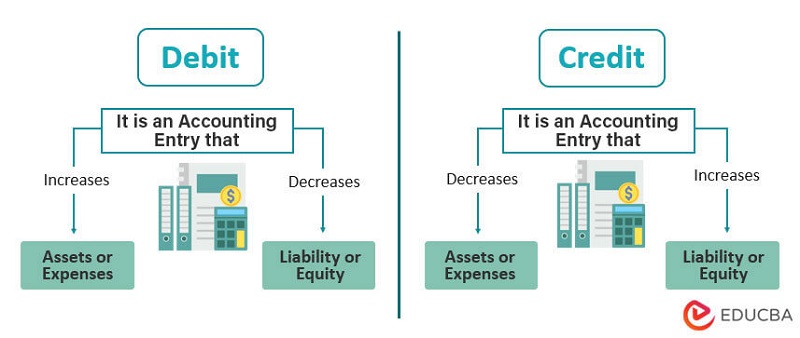

Debits and credits represent the two sides of a financial transaction. They aren’t inherently increases or decreases, but rather signify where value (economic benefit) flows within the accounting system.

- Why are Debits and Credits Important?

They serve as the foundation for the double-entry accounting system. This system ensures every transaction has a corresponding and opposite entry, maintaining a balance in the company’s financial records.

- The Double-Entry Accounting System

Imagine a seesaw. Debits and credits act like the two ends of the seesaw. When you add weight (value) on one side (debit), the other side (credit) must adjust to maintain balance. This ensures the total value entering the system equals the total value leaving it.

Understanding the Flow of Economic Benefit

Think of debits and credits as source and destination for economic benefit:

- Debits vs. Credits: A Source and Destination Analogy

- Debits represent the destination where economic benefit flows into an account. Imagine money flowing in to your wallet; this would be a debit.

- Credits represent the source from where economic benefit flows out of an account. Think of money flowing out of your wallet for a purchase; this would be a credit.

- Debits Represent Increases in Assets, Expenses, and Losses

- When you debit an asset account (e.g., cash, inventory), the value of that asset increases.

- Debiting an expense account (e.g., rent, utilities) reflects an increase in the cost of running the business.

- Similarly, debiting a loss account signifies a decrease in owner’s equity due to unforeseen circumstances.

- Credits Represent Increases in Liabilities, Equity, and Revenues

- Conversely, crediting a liability account (e.g., accounts payable, loans) signifies an increase in the amount owed to creditors.

- Crediting an equity account (e.g., owner’s capital) reflects an increase in owner’s investment in the business.

- When you credit a revenue account (e.g., sales), it represents an increase in income generated from business activities.

- Debits and Credits: Maintaining Balance

Remember, the seesaw analogy! In every transaction, the total debits must always equal the total credits. This ensures the accounting equation (discussed later) remains balanced.

Decoding Account Types

Understanding the different types of accounts is crucial for using debits and credits effectively. Here’s a quick breakdown:

- Assets: What a Business Owns

These accounts represent the resources and valuables owned by the business, such as cash, inventory, equipment, and buildings.

- Liabilities: What a Business Owns Others

These accounts represent the company’s financial obligations, such as amounts owed to suppliers (accounts payable) or loans taken from banks.

- Equity: Owner’s Investment in the Business

This account reflects the owner’s financial stake in the company, including their initial investment and retained earnings (profits accumulated over time).

- Revenues: Income Generated from Business Activities

These accounts represent the income earned by the business through sales of goods or services.

- Expenses: Costs Incurred to Run the Business

These accounts represent the costs associated with operating the business, such as rent, salaries, and utilities.

Now that you grasp the basic concepts of debits and credits, let’s delve deeper into their practical application.

4. The Accounting Equation: A Balancing Act

The accounting equation is the foundation of double-entry accounting. It’s a fundamental formula that expresses the relationship between a company’s assets, liabilities, and equity:

Assets = Liabilities + Equity

Imagine a scale where Assets rest on one side, balanced by Liabilities and Equity on the other.

- How Debits and Credits Impact the Equation

Every transaction you record with debits and credits will affect this equation. Here’s how:

- Debiting an asset account increases the total assets on the left side of the equation.

- Crediting an asset account decreases the total assets.

- Debiting a liability or equity account increases the total on the right side.

- Crediting a liability or equity account decreases the total on the right side.

- Understanding Normal Account Balances

Each account type (asset, liability, etc.) has a normal balance. This refers to the expected ending balance of the account after all transactions are recorded.

- Asset accounts normally have debit balances.

- Liability and equity accounts normally have credit balances.

Understanding normal account balances helps you determine whether to debit or credit an account to maintain its balance and the overall balance of the equation.

Transactions and their Impact

Let’s see how debits and credits are used in real-world business transactions:

- Common Business Transactions Explained with Debits and Credits

Here are some examples to illustrate the application of debits and credits:

-

Buying Supplies for Cash

- Debit: Supplies (asset) – The value of supplies increases.

- Credit: Cash (asset) – Cash paid out decreases.

-

Paying Rent with Cash

- Debit: Rent Expense (expense) – The cost of running the business increases.

- Credit: Cash (asset) – Cash paid out decreases.

-

Selling Products or Services on Credit

- Debit: Accounts Receivable (asset) – The amount owed by customers increases (a new asset is created).

- Credit: Sales Revenue (revenue) – Income earned from the sale increases.

-

Receiving Payment from Customers

- Debit: Cash (asset) – Cash received increases.

- Credit: Accounts Receivable (asset) – The amount owed by customers decreases.

-

Recording Depreciation Expense

- Debit: Depreciation Expense (expense) – The cost associated with wear and tear on assets increases.

- Credit: Accumulated Depreciation (contra-asset) – The decrease in the value of the asset due to depreciation is tracked. (Contra-assets are assets with a credit balance that reduce the value of the original asset account.)

Remember: When analyzing transactions, identify the accounts affected and whether they represent an increase or decrease in value. Then, use the “DEAL” method or normal account balances (discussed later) to determine the appropriate debit or credit.

Memorizing Debits and Credits: Helpful Tips

Mastering debits and credits can feel overwhelming at first. Here are some strategies to solidify your understanding:

- The “DEAL” Method: A Simple Approach

This mnemonic device can help you remember which accounts to debit and credit:

- Debit: Expense and Loss accounts

- Credit: Equity and Revenue accounts

By remembering this, you can quickly identify whether an account should be increased (debit) or decreased (credit) based on its type.

- “T-Accounts” for Visualization

T-accounts are a visual representation of an account with two sides: debit and credit. You can practice recording transactions by entering debits on the left side (T) and credits on the right side. This helps you visualize the impact of transactions on account balances.

- Mnemonic Devices and Flashcards

Create your own memory aids or flashcards to solidify your understanding. Use catchy phrases or rhymes to associate debits and credits with specific account types.

By employing these techniques, you’ll develop a stronger foundation for working with debits and credits.

Advanced Debits and Credits

As your accounting knowledge expands, you’ll encounter more complex transactions. Here’s a glimpse into some advanced applications:

- Non-Cash Transactions

Not all transactions involve immediate cash flow. Debits and credits come into play when recording these transactions as well.

-

Recording Accounts Payable and Accrued Expenses

Imagine you receive services from a supplier today, but agree to pay them next month. This creates an account payable (liability) for the amount owed.

- Debit: Expense (e.g., Utilities Expense) – The cost of the service increases expense.

- Credit: Accounts Payable (liability) – The amount owed to the supplier increases.

-

Recording Prepaid Expenses

Sometimes, you pay for expenses in advance. For instance, you might prepay a year’s worth of insurance. This creates a prepaid expense (asset) account.

- Debit: Prepaid Expense (asset) – The value of the prepaid service increases assets.

- Credit: Cash (asset) – Cash paid out decreases.

As the service is used over time, the prepaid expense is gradually converted into an expense through adjusting entries (explained later in accounting courses).

- Correcting Errors: Debits and Credits for Adjustments

Even the most meticulous bookkeeper can make mistakes. Debits and credits play a role in correcting these errors.

-

Journal Entries for Common Accounting Errors

Imagine you accidentally debited an expense account instead of crediting it. To rectify this, you’d make a journal entry (a formal record of a transaction) with a correcting entry.

- Debit: The originally credited expense account (to increase it to the correct amount).

- Credit: The expense account that was mistakenly debited (to decrease it back to zero).

There are various types of errors and corresponding correcting entries. Consulting with an accountant or referring to accounting resources can help you navigate these situations.

By understanding these advanced concepts, you’ll be well-equipped to handle a wider range of accounting transactions.

FAQs – Debits and Credits Demystified

This section tackles some of the most common questions people have about debits and credits:

Is a Debit an Increase or Decrease?

Remember, debits and credits don’t universally signify increases or decreases. It depends on the type of account you’re dealing with.

- Debits increase asset, expense, and loss accounts.

- Debits decrease liability and equity accounts.

Think of debits as “putting something in” to an account, and credits as “taking something out.” However, what’s being “put in” or “taken out” depends on the account type.

When to Use Debit and When to Use Credit?

Here are two helpful approaches to determine when to use a debit or credit:

-

Referencing the “DEAL” Method:

Use the DEAL method as a quick reference:

- Debit: Expense and Loss accounts

- Credit: Equity and Revenue accounts

-

Understanding Normal Account Balances:

Each account type has a normal balance. Knowing these balances helps you determine the appropriate debit or credit to maintain balance:

- Debit for accounts with normal debit balances (assets).

- Credit for accounts with normal credit balances (liabilities and equity).

If you’re unsure, analyze the transaction and identify the affected accounts. Then, use the DEAL method or consider the normal account balance to determine the appropriate debit or credit.

What if I Forget How to Debit or Credit an Account?

Don’t worry! It’s normal to forget sometimes. Here are some resources to refresh your memory:

-

Consulting Reference Materials:

- Accounting textbooks or online resources often provide detailed explanations and examples of debits and credits for different account types.

-

Accounting Software with Practice Features:

Many accounting software programs offer practice modules where you can experiment with debits and credits in a simulated environment.

Are There Any Free Resources to Learn More About Debits and Credits?

Absolutely! The internet offers a wealth of free resources to deepen your understanding:

-

Online Accounting Tutorials:

Several websites and educational platforms offer free video tutorials or interactive courses on accounting basics, including debits and credits.

-

Accounting Software with Free Trials:

Some accounting software programs have free trial periods that allow you to explore their practice features and experiment with debits and credits in a user-friendly interface.

By utilizing these resources alongside the information in this article, you’ll be well on your way to mastering debits and credits!

Resources

- Anchor Text: Investopedia’s Guide to Debits and Credits

- Khan Academy’s Free Accounting Course

- 3 Ways To Explain Accounting Equation