Financial Freedom Starts Here: Budgeting and Cash Flow Management for Small Businesses

July 30, 2024

Why You’re Doing It Wrong: How to Hire a Bookkeeper That Fits Your Needs

September 20, 2024Introduction to Financial Statements

Financial statements are crucial for businesses to convey their financial status and performance to stakeholders. They provide insights into a company’s operations, financial health, and profitability, facilitating informed decision-making by investors, creditors, and management. Among the most critical financial statements are the balance sheet and the profit and loss statement, each serving unique purposes and offering distinct insights.

Understanding the Balance Sheet

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial standing at a specific point in time. It outlines what the company owns (assets), what it owes (liabilities), and the residual interest in the assets after deducting liabilities (equity).

Components of the Balance Sheet

Assets, liabilities, and equity are the three primary components of the balance sheet. These elements are crucial in understanding the financial structure and health of a business.

Types of Assets

Current assets are those expected to be converted into cash within a year, such as cash, accounts receivable, and inventory. Non-current assets include long-term investments, property, plant, and equipment, which are not readily convertible into cash within a year.

Current Assets:

- Cash and Cash Equivalents: These are the most liquid assets, including cash on hand and short-term investments.

- Accounts Receivable: Money owed to the company by customers for sales made on credit.

- Inventory: Goods available for sale, including raw materials, work-in-progress, and finished goods.

- Prepaid Expenses: Payments made in advance for goods or services to be received in the future, such as insurance or rent.

Non-Current Assets:

- Property, Plant, and Equipment (PP&E): Long-term physical assets used in operations, like buildings, machinery, and land.

- Intangible Assets: Non-physical assets with long-term value, such as patents, trademarks, and goodwill.

- Long-Term Investments: Investments in stocks, bonds, or other assets intended to be held for more than a year.

- Deferred Tax Assets: Reductions in future tax liabilities due to deductible temporary differences and carryforwards.

Types of Liabilities

Current liabilities are obligations a company needs to settle within a year, such as accounts payable and short-term loans. Long-term liabilities are debts or obligations that are due beyond one year, including bonds payable and long-term leases.

Current Liabilities:

- Accounts Payable: Money the company owes to suppliers for purchases made on credit.

- Short-Term Debt: Loans and other borrowings due within one year.

- Accrued Expenses: Expenses that have been incurred but not yet paid, such as wages and utilities.

- Deferred Revenue: Money received in advance for goods or services yet to be delivered.

Long-Term Liabilities:

- Bonds Payable: Debt securities issued by the company to investors, repayable over a long period.

- Long-Term Loans: Bank loans and other forms of financing due beyond one year.

- Deferred Tax Liabilities: Taxes owed in the future due to temporary differences between accounting and tax rules.

- Pension Liabilities: Obligations related to employee retirement benefits.

Equity in the Balance Sheet

Equity represents the owners’ claim on the assets of the business after all liabilities have been deducted. It includes owner’s equity, which is the capital invested by the owners, and retained earnings, which are the cumulative profits reinvested in the business.

Components of Equity:

- Common Stock: The value of shares issued to shareholders.

- Preferred Stock: A class of ownership with preferential rights over common stock, often with fixed dividends.

- Additional Paid-In Capital: Amounts paid by investors above the par value of shares.

- Retained Earnings: Profits retained in the business rather than distributed as dividends.

- Treasury Stock: Shares repurchased by the company from shareholders.

Reading a Balance Sheet

Interpreting a balance sheet involves analyzing the relationship between assets, liabilities, and equity. Key ratios, such as the current ratio and debt-to-equity ratio, help assess liquidity, solvency, and overall financial stability.

Key Ratios:

- Current Ratio: Current assets divided by current liabilities, indicating the company’s ability to pay short-term obligations.

- Quick Ratio: (Current assets – Inventory) divided by current liabilities, providing a more stringent measure of liquidity.

- Debt-to-Equity Ratio: Total liabilities divided by total equity, showing the proportion of debt to shareholders’ equity.

- Return on Equity (ROE): Net income divided by shareholders’ equity, measuring profitability relative to equity.

Balance Sheet Example

A sample balance sheet might look like this:

| Assets | Liabilities & Equity |

|---|---|

| Current Assets | |

| Cash | $10,000 |

| Accounts Receivable | $5,000 |

| Inventory | $7,000 |

| Total Current Assets | $22,000 |

| Non-Current Assets | |

| Property, Plant & Equipment | $50,000 |

| Total Assets | $72,000 |

| Current Liabilities | |

| Accounts Payable | $8,000 |

| Short-Term Debt | $5,000 |

| Total Current Liabilities | $13,000 |

| Long-Term Liabilities | $25,000 |

| Total Liabilities | $38,000 |

| Equity | |

| Owner’s Equity | $20,000 |

| Retained Earnings | $14,000 |

| Total Equity | $34,000 |

| Total Liabilities & Equity | $72,000 |

Understanding the Profit and Loss Statement

The profit and loss statement, also known as the income statement, shows a company’s financial performance over a specific period. It details how revenue is transformed into net income by subtracting expenses.

Components of the Profit and Loss Statement

The primary components are revenue, expenses, and net income. This statement provides insight into a company’s ability to generate profit by increasing revenue and managing costs.

Revenue in the Profit and Loss Statement

Revenue, or sales, represents the total amount of money generated from goods sold or services provided. It can be classified into operating revenue, which comes from primary business activities, and non-operating revenue, from secondary activities like investments.

Types of Revenue:

- Sales Revenue: Income from selling goods or services.

- Service Revenue: Income from providing services.

- Interest Revenue: Income from investments in interest-bearing assets.

- Rental Revenue: Income from leasing out property or equipment.

- Dividend Revenue: Income from dividends received from investments in other companies.

Expenses in the Profit and Loss Statement

Expenses are the costs incurred to generate revenue. Operating expenses include costs directly related to the core business activities, such as cost of goods sold (COGS) and administrative expenses. Non-operating expenses are unrelated to primary business operations, such as interest expense.

Types of Expenses:

- Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold by the company.

- Selling, General, and Administrative Expenses (SG&A): Overhead costs such as salaries, rent, and utilities.

- Depreciation and Amortization: Allocation of the cost of tangible and intangible assets over their useful lives.

- Interest Expense: Cost of borrowing funds.

- Tax Expense: Corporate income taxes paid to the government.

Calculating Net Income

Net income is the profit remaining after all expenses have been deducted from revenue. It is calculated by subtracting total expenses from total revenue. Gross profit, derived from revenue minus COGS, provides insight into profitability before other expenses are considered.

Net Income Calculation:

- Gross Profit: Revenue – COGS

- Operating Income: Gross Profit – Operating Expenses

- Net Income: Operating Income – Interest Expense – Tax Expense

Reading a Profit and Loss Statement

Interpreting a profit and loss statement involves analyzing revenue streams and expense categories to assess profitability. Key metrics include gross profit margin, operating margin, and net profit margin.

Key Metrics:

- Gross Profit Margin: Gross profit divided by revenue, indicating the efficiency of production.

- Operating Margin: Operating income divided by revenue, showing core business profitability.

- Net Profit Margin: Net income divided by revenue, measuring overall profitability after all expenses.

Profit and Loss Statement Example

A sample profit and loss statement might look like this:

| Revenue | Amount |

|---|---|

| Sales Revenue | $100,000 |

| Total Revenue | $100,000 |

| Expenses | |

| Cost of Goods Sold | $40,000 |

| Administrative Expenses | $20,000 |

| Selling Expenses | $15,000 |

| Total Operating Expenses | $75,000 |

| Operating Income | $25,000 |

| Interest Expense | $5,000 |

| Net Income | $20,000 |

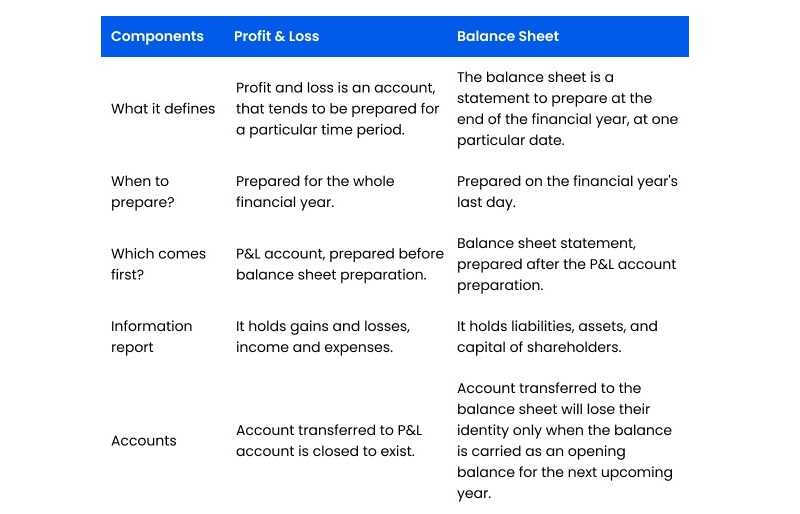

Differences Between Balance Sheet and Profit and Loss Statement

While the balance sheet provides a snapshot of a company’s financial position at a specific point in time, the profit and loss statement details financial performance over a period. The balance sheet focuses on assets, liabilities, and equity, whereas the profit and loss statement emphasizes revenue, expenses, and net income.

Key Differences:

- Timing: Balance sheet is a snapshot at a point in time; profit and loss statement covers a period.

- Focus: Balance sheet shows financial position; profit and loss statement shows performance.

- Components: Balance sheet includes assets, liabilities, and equity; profit and loss statement includes revenue, expenses, and net income.

- Purpose: Balance sheet assesses financial stability; profit and loss statement assesses profitability.

How Balance Sheets and Profit and Loss Statements Complement Each Other

Together, these statements offer a comprehensive view of a company’s financial health. The balance sheet reveals what a company owns and owes, while the profit and loss statement shows profitability. Analyzing both provides insights into operational efficiency and financial stability.

Common Misconceptions

One common misconception is that a balance sheet shows a company’s profitability, which it does not; it only indicates financial position. Another is that the profit and loss statement reflects financial health, while it actually focuses on performance.

Importance for Business Decision Making

These financial statements are crucial for strategic planning, investment decisions, and assessing the financial viability of a business. They help identify trends, strengths, weaknesses, and opportunities, guiding informed decision-making.

Strategic Planning: Financial statements provide the data needed to set realistic goals, allocate resources efficiently, and plan for future growth.

Investment Decisions: Investors use these statements to evaluate the potential returns and risks of investing in a company.

Financial Viability: By analyzing financial statements, businesses can assess their ability to meet obligations, maintain operations, and achieve profitability.

FAQs

Q: What is the primary purpose of a balance sheet?

- A: The primary purpose of a balance sheet is to provide a snapshot of a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity.

Q: How does the profit and loss statement differ from the balance sheet?

- A: The profit and loss statement details financial performance over a period, focusing on revenue, expenses, and net income, while the balance sheet provides a snapshot of financial position, focusing on assets, liabilities, and equity.

Q: Why are both the balance sheet and profit and loss statement important?

- A: Together, they offer a comprehensive view of a company’s financial health, with the balance sheet showing financial position and the profit and loss statement showing performance. This helps in making informed business decisions.

Q: What information can be derived from a balance sheet?

- A: A balance sheet reveals what a company owns (assets), what it owes (liabilities), and the residual interest in the assets after deducting liabilities (equity), helping assess financial stability and structure.

Q: How can net income be calculated?

- A: Net income is calculated by subtracting total expenses from total revenue, providing insight into profitability after all costs have been accounted for.

Q: What are common errors to avoid when reading these financial statements?

- A: Common errors include confusing profitability with financial position, misinterpreting revenue types, and not considering the context of the financial period or the specific industry.

Conclusion

Understanding the balance sheet and the profit and loss statement is fundamental for assessing a company’s financial health and performance. Each statement serves a unique purpose, providing valuable insights that, when combined, offer a comprehensive view of the business. Accurate interpretation and analysis of these financial documents are crucial for making informed decisions and driving business success.

Resources

Investopedia’s Guide to Balance Sheets

Understanding Income Statements

Learn More About Financial Ratios

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.