3 Accounting Mistakes You Can’t Afford to Make

October 1, 2024

Learn Cash Flow Statement Essentials: Your Key to Financial Success!

October 28, 2024Introduction to Financial Terms

In finance and accounting, assets, liabilities, and equity are key components of a company’s financial statements. These three categories form the foundation of a company’s balance sheet, which gives a snapshot of its financial health. Understanding them is crucial for anyone involved in managing, investing in, or analyzing a business.

What Are Assets?

Assets represent everything a company owns that has value and can contribute to its economic future. These are resources that a business uses to generate revenue, ranging from cash in the bank to equipment used for production.

Types of Assets

- Current assets: These are short-term assets expected to be converted into cash or used within a year. Examples include cash, accounts receivable, and inventory.

- Non-current assets: Long-term investments or assets that will be used over many years, such as property, plant, and equipment (PPE).

Tangible vs. Intangible Assets

- Tangible assets: Physical items like buildings, machinery, and inventory.

- Intangible assets: Non-physical assets such as patents, trademarks, and goodwill.

How Assets Are Valued

Assets are typically valued at their purchase price or market value. In some cases, depreciation is applied, particularly for physical assets like machinery, to account for their gradual loss in value over time.

Types of Assets

Assets can be broken down into categories that reflect their nature and how they contribute to the business:

- Financial assets: Cash, stocks, and bonds, which provide liquidity and can be easily converted into cash.

- Physical assets: These include property, plant, and equipment (PPE), all of which are used directly in business operations.

- Intangible assets: Patents, trademarks, and goodwill that provide competitive advantages but do not have a physical presence.

What Are Liabilities?

Liabilities are financial obligations that a company owes to others. These debts must be paid over time and are recorded on the balance sheet as part of the company’s obligations.

Types of Liabilities

- Current liabilities: Short-term debts that are expected to be settled within a year, such as accounts payable and short-term loans.

- Long-term liabilities: Debts that will be paid over a longer period, like mortgages and bonds.

Common Liabilities

Common liabilities include loans from financial institutions, corporate bonds issued to investors, and accounts payable, which reflect unpaid invoices for goods and services received.

Types of Liabilities

Different kinds of liabilities show how much and where a company owes:

- Financial liabilities: These typically include loans, mortgages, and bonds issued by the company.

- Operational liabilities: Such as accounts payable, wages owed to employees, and accrued expenses.

- Contingent liabilities: Potential liabilities that depend on the outcome of a future event, such as legal disputes.

What is Equity?

Equity represents the ownership value in a company after all liabilities have been subtracted from its assets. It’s essentially what would be left over for the shareholders or owners if the company sold off all its assets and paid off all its debts.

How Equity is Calculated

The basic equation for calculating equity is:

Assets – Liabilities = Equity

Equity provides insight into the company’s net worth, which is critical for shareholders, investors, and business owners to understand.

Importance of Equity in Financial Health

A positive equity value indicates that a company has more assets than liabilities, which is a sign of good financial health. Negative equity, on the other hand, could signal financial distress.

Types of Equity

- Shareholder equity: The value attributable to shareholders, typically consisting of common stock, preferred stock, and retained earnings.

- Owner’s equity: In sole proprietorships or partnerships, this represents the owners’ personal stake in the business.

- Paid-in capital: This refers to money that shareholders have invested in exchange for shares of the company.

- Treasury stock: These are shares that the company has bought back from investors.

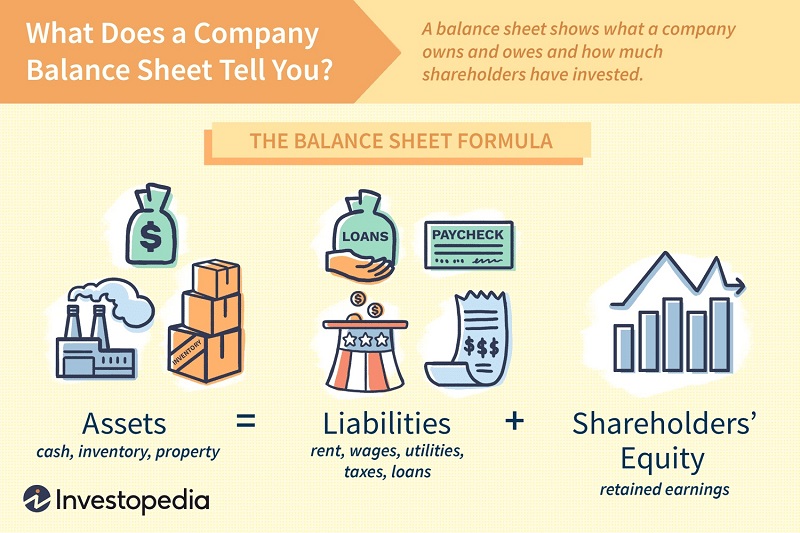

The Balance Sheet Equation

The balance sheet equation ties together assets, liabilities, and equity in the following way:

Assets = Liabilities + Equity

This fundamental accounting equation shows that a company’s resources (assets) are funded by either borrowing money (liabilities) or through the owners’ investment (equity). This equation underpins the balance sheet, which is a key financial statement.

Assets and Their Role in Business

Assets are vital to a company’s operations because they are the tools used to produce goods and services, generate sales, and, ultimately, earn profit. Businesses use their assets to invest in growth opportunities, expand their operations, or maintain day-to-day activities.

Liabilities and Risk Management

Liabilities, while necessary for growth, come with risks. Too much debt can lead to financial strain, especially if the company struggles to meet its repayment obligations. Properly managing liabilities is key to maintaining a healthy balance sheet and avoiding insolvency.

Equity and Business Ownership

Equity plays a crucial role in ownership. For corporations, issuing stock (equity) is a way to raise capital without taking on debt. Equity holders, or shareholders, effectively own part of the company and are entitled to a share of its profits.

Differences Between Assets, Liabilities, and Equity

The key differences lie in their function:

- Assets are what a company owns.

- Liabilities are what a company owes.

- Equity is the ownership value in the company after liabilities are settled.

Analyzing Financial Health

Analyzing the balance of assets, liabilities, and equity helps assess a company’s financial health. Important ratios, such as the debt-to-equity ratio and return on equity, provide insight into how efficiently a company is using its equity to generate profits and how much debt it is taking on relative to its equity.

Practical Examples

Example 1: A Small Business Balance Sheet

A small retail shop might have $50,000 in inventory (assets), owe $10,000 to suppliers (liabilities), and have $40,000 in equity owned by the business owner.

Example 2: Corporate Balance Sheet

A large corporation may have billions in assets, funded by both long-term debt (liabilities) and investments from shareholders (equity).

Conclusion

Understanding assets, liabilities, and equity is essential for analyzing any business’s financial status. These three components provide a clear picture of a company’s financial structure, helping stakeholders make informed decisions.

FAQs: Assets, Liabilities & Equity

Q: What are assets in accounting?

A: Assets are resources owned by a company that have economic value and can generate future benefits. They include items like cash, inventory, equipment, property, and even intangible assets like patents and trademarks.

Q: What is the difference between current and non-current liabilities?

A: Current liabilities are obligations a company must pay within one year, such as accounts payable and short-term loans. Non-current liabilities, on the other hand, are debts that will be settled over a longer period, such as mortgages and long-term bonds.

Q: How is equity calculated?

A: Equity is calculated using the formula:

Equity = Assets – Liabilities

It represents the residual interest in the company after all liabilities have been paid. For corporations, equity can include retained earnings, common stock, and paid-in capital.

Q: Why is the balance sheet equation important?

A: The balance sheet equation, Assets = Liabilities + Equity, is crucial because it shows how a company’s resources (assets) are financed through debt (liabilities) and owners’ equity. It ensures that a company’s financial statements are balanced and accurate.

Q: What are examples of intangible assets?

A: Intangible assets are non-physical resources that still have value. Examples include patents, copyrights, trademarks, goodwill, and brand recognition. These assets can provide competitive advantages and are often vital to a company’s success.

Resources

Understanding the Role of Intangible Assets in Business

- This Investopedia page provides a detailed explanation of intangible assets.

- AccountingCoach offers a simple guide on reading a balance sheet, ideal for readers who want a deeper understanding of the balance sheet equation.

Debt-to-Equity Ratio and Its Importance

- Explains the debt-to-equity ratio, a key financial ratio.

DISCLAIMER: The information in this article is for informational purposes only and is not meant to take the place of legal and accounting advice.