Beyond the Business: Exploring Different Investment Options for Entrepreneurial Success

December 7, 2023

Futureproof Your Small Business: Essential Strategic Planning Tips for Uncertain Times

December 19, 2023Part 1: Understanding Your Financing Needs and the Funding Landscape (1,000 Words)

Navigating the Maze: Why Financing Matters for Small Businesses

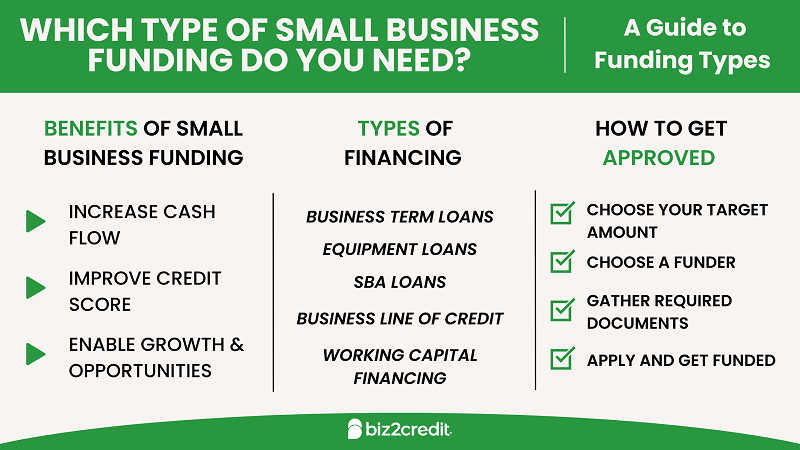

Starting and growing a successful small business often requires navigating the maze of financial decisions. While passion and dedication are crucial, securing the right financing can be the difference between a thriving venture and a struggling one. Access to capital unlocks doors, allowing you to invest in critical resources, expand operations, and weather unforeseen challenges. With numerous financing options available, understanding your specific needs and choosing the perfect fit becomes essential for sustainable growth.

Decoding Your Needs: Identifying What Your Business Requires

Not all financing options are created equal. Each caters to distinct stages in a business’s journey and addresses specific financial goals. Ask yourself:

- Am I launching a new venture and require startup capital?

- Do I need to bridge a temporary cash flow gap?

- Is expansion on the horizon, necessitating equipment acquisition or inventory investment?

- Do I need to refinance existing debt for better terms?

Defining your funding objectives will guide your search for the optimal financing solution. Remember, the right loan or investment shouldn’t simply fill a financial void; it should propel your business forward.

Demystifying the Funding Landscape: A Look at Available Options

The world of small business financing is diverse, offering a spectrum of options to suit various needs and creditworthiness. Here’s a glimpse into the funding landscape:

- Traditional Bank Loans:

- SBA Loans: Government-backed loans with favorable terms for qualified businesses.

- Term Loans: Fixed-rate loans for specific purposes like equipment purchase or property acquisition.

- Lines of Credit: Flexible credit lines for ongoing operational expenses or short-term needs.

- Alternative Lenders and Online Platforms:

- Online Lenders: Faster and more flexible loan options, often with higher interest rates.

- Peer-to-Peer Lending: Borrow directly from individual investors through online platforms.

- Grants and Crowdfunding:

- Grants: Free funding from government agencies or non-profit organizations, often requiring specific criteria.

- Crowdfunding: Raise capital by collecting small contributions from a large pool of individuals.

- Business Credit Cards:

- Convenient for covering small expenses or building business credit.

- Be wary of high interest rates and potential for debt accumulation.

- Asset-Based Financing:

- Invoice Factoring: Sell outstanding invoices at a discount for immediate cash flow.

- Equipment Loans: Secure financing by using business assets as collateral.

- Angel Investors and Venture Capital:

- Equity Financing: Investors provide capital in exchange for ownership stake in the business.

- Suitable for high-growth potential businesses seeking significant funding.

- Personal Investment and Bootstrapping:

- Self-funding can be a viable option for low-cost businesses or those with strong personal finances.

- Bootstrapping involves utilizing creative strategies to minimize expenses and maximize revenue.

Remember, this list is not exhaustive. Researching and comparing different options is crucial to finding the perfect match for your unique business needs.

Creditworthiness Check: Understanding Your Borrowing Power

Your credit score and business financials play a significant role in securing financing. Lenders assess your creditworthiness to determine your ability to repay the loan. A strong credit score can unlock lower interest rates and more favorable loan terms. Conversely, a low credit score may limit your options or lead to higher costs.

Strengthening your financial health before applying for financing can significantly improve your chances. This includes building good business credit, maintaining accurate financial records, and demonstrating a clear path to profitability.

Part 2: Matching Your Needs with the Right Option: A Deep Dive

Diving Deeper: Examining Specific Financing Options in Detail

Now that you understand your funding needs and the financing landscape, let’s delve deeper into each option, exploring their advantages, disadvantages, and suitability for different scenarios:

Traditional Bank Loans:

- SBA Loans:

- Advantages: Competitive interest rates, government guarantee, flexible terms.

- Disadvantages: Rigorous application process, stricter eligibility requirements.

- Best for: Established businesses with strong financials seeking larger loans for expansion or property acquisition.

- Term Loans:

- Advantages: Predictable repayment schedule, fixed interest rates.

- Disadvantages: Less flexibility than lines of credit, may require collateral.

- Best for: Specific one-time purchases like equipment or renovation.

- Lines of Credit:

- Advantages: Access to funds as needed, convenient for managing cash flow fluctuations.

- Disadvantages: Variable interest rates, potential for overspending.

- Best for: Covering operational expenses, seasonal inventory needs, or bridging temporary gaps.

Alternative Lenders and Online Platforms:

- Online Lenders:

- Advantages: Faster approval process, flexible eligibility requirements.

- Disadvantages: Higher interest rates compared to traditional banks.

- Best for: Businesses with less-than-perfect credit or needing quick access to capital.

- Peer-to-Peer Lending:

- Advantages: Personalized loan terms, potential for lower interest rates.

- Disadvantages: Longer approval process, risk of not reaching funding goal.

- Best for: Businesses with strong business plans and creditworthy borrowers.

Grants and Crowdfunding:

- Grants:

- Advantages: Free funding, no repayment required.

- Disadvantages: Competitive application process, specific eligibility criteria, funding amounts may be limited.

- Best for: Non-profit organizations, businesses with social impact goals, or those requiring startup capital.

- Crowdfunding:

- Advantages: Builds brand awareness, engages potential customers, raises capital without debt.

- Disadvantages: Time-consuming campaign management, success depends on effective marketing and communication.

- Best for: Creative ventures, businesses with strong online presence, or those seeking community support.

Business Credit Cards:

- Advantages: Convenient for small expenses, builds business credit history.

- Disadvantages: High interest rates, potential for debt accumulation.

- Best for: Covering travel, office supplies, or short-term purchases.

Asset-Based Financing:

- Invoice Factoring:

- Advantages: Immediate cash flow, improves working capital.

- Disadvantages: Factoring fees can be high, may damage relationships with customers.

- Best for: Businesses with a strong invoicing system and predictable receivables.

- Equipment Loans:

- Advantages: Secure financing without personal liability, frees up capital for other needs.

- Disadvantages: Requires collateral, may have strict repayment terms.

- Best for: Acquiring essential equipment for operations or growth.

Angel Investors and Venture Capital:

- Advantages: Access to significant funding, mentorship and guidance from experienced investors.

- Disadvantages: Relinquishing ownership stake, meeting high growth expectations, pressure to achieve quick results.

- Best for: High-growth potential businesses with innovative ideas and strong market traction.

Personal Investment and Bootstrapping:

- Advantages: Retains full ownership, avoid debt, fosters self-reliance and creativity.

- Disadvantages: Limited available capital, slower growth, may require personal financial sacrifice.

- Best for: Businesses with low overhead costs, strong founder commitment, and a focus on organic growth.

Remember: This is not an exhaustive list, and the best option ultimately depends on your specific needs and circumstances.

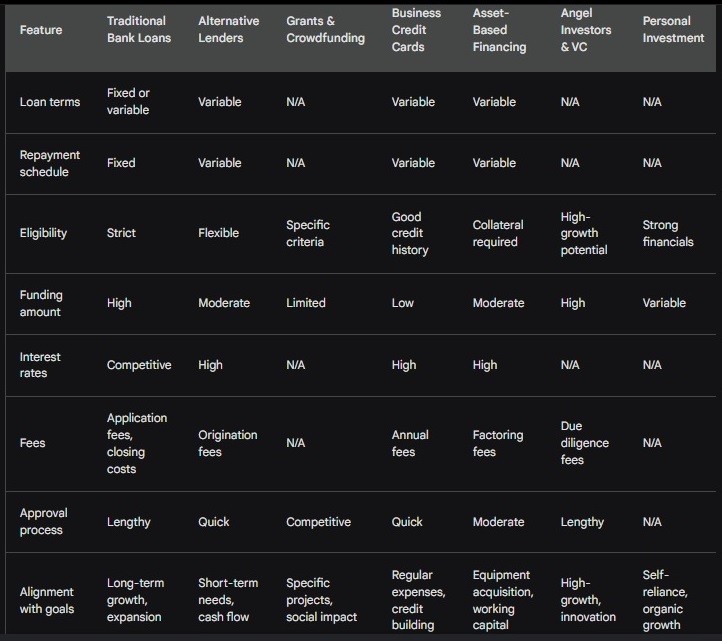

Comparing and Contrasting: Finding the Perfect Fit for Your Needs

Now that you have a detailed understanding of each financing option, it’s time to compare and contrast your choices. Consider the following factors:

- Loan terms and repayment schedules: Fixed vs. variable interest rates, repayment periods, grace periods.

- Eligibility requirements: Credit score, business financials, collateral requirements.

- Funding amount and terms: Access to capital, fees, interest rates, approval process speed.

- Alignment with your business goals: Does the financing support your short-term or long-term objectives?

Create a comparison table to visually assess the pros and cons of each option. This will help you identify the perfect fit for your specific financial needs and business aspirations.

Beyond the Loan: Alternative Financing Strategies for Unique Needs

For some businesses, traditional financing may not be the perfect solution. Explore these alternative strategies for unique needs:

- Bartering: Trade goods or services with other businesses to acquire needed resources.

- Factoring receivables: Sell outstanding invoices to a factoring company for immediate cash.

- Revenue-based financing: Investors provide funding based on a percentage of your future revenue.

- Pre-selling products or services: Generate revenue upfront to fund your business launch.

FAQs: Answers to Your Pressing Questions about Small Business Financing

- Q: How much financing do I need?

- A: The amount varies depending on your business goals and needs. Develop a detailed financial plan to estimate your required capital.

- Q: Can I get a loan with bad credit?

- A: While it might be challenging, some lenders cater to businesses with lower credit scores. Consider alternative options like microloans or bootstrapping.

- Q; What are the risks of crowdfunding?

- A: Not reaching your funding goal, facing pressure from investors, and giving up ownership equity.

- Q: What are the best resources for finding funding?

- A: The SBA website, SCORE, and online funding platforms like Fundera offer resources and guidance.

- Q: How can I improve my creditworthiness?

- A: Pay bills on time, maintain low credit card balances, and build a strong business credit history.

Remember, seeking professional guidance from financial advisors or lenders can be invaluable in navigating the complex world of small business financing.

Conclusion:

Matching the right financing option to your needs is crucial for your small business’s success. By understanding your goals, researching your options, and carefully comparing different solutions, you can make informed decisions that fuel your growth and propel you towards your entrepreneurial dreams.

Resources

U.S. Small Business Administration (SBA)

- This is a highly relevant and authoritative source from the government itself, offering comprehensive information on various SBA loan programs, eligibility requirements, and application procedures. It reinforces the article’s focus on responsible financing and provides practical resources for readers.

SCORE: Mentors to help small businesses grow

- SCORE is a non-profit organization offering free or low-cost mentoring and educational resources to small businesses. It aligns with the article’s emphasis on seeking professional guidance and provides a valuable resource for readers seeking additional support beyond financing options.

Fundera: Compare loan options from multiple lenders

- Fundera is a neutral platform that allows users to compare loan options from various lenders, ensuring transparency and facilitating informed decision-making. This complements the article’s focus on comparing and contrasting different financing solutions and provides a practical tool for readers to explore specific loan options based on their needs.