What type of accountant is best for small business?

October 13, 2023

Smart Strategies for Small Business Tax Savings

October 30, 2023Introduction

Small businesses often find themselves on a financial tightrope, and one misstep can have significant repercussions. This is where cash flow management comes into play. It’s not just an accounting term; it’s the lifeline of your business. In this chapter, we’ll delve into the importance of cash flow management and why it’s crucial for small businesses. You’ll understand how effective cash flow management directly impacts your business’s sustainability.

Common Challenges in Small Business Cash Flow

The journey of small business cash flow is fraught with challenges. We’ll explore these hurdles, from delayed payments to unexpected expenses, and provide real-world examples of businesses that have been affected by cash flow issues. Understanding these challenges is the first step toward overcoming them.

The Fundamentals of Cash Flow Management

Defining Cash Flow

To navigate the complexities of cash flow management, you need a solid foundation. We’ll start by explaining what cash flow entails and how it differs from profit. It’s essential to distinguish between the two to make informed financial decisions for your small business.

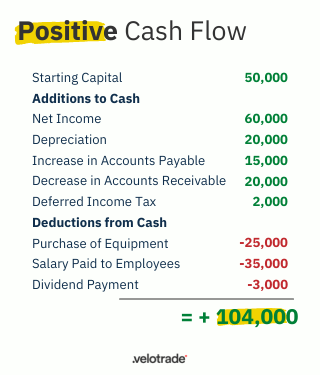

The Cash Flow Statement

A cash flow statement is your compass in the world of finance. We’ll guide you through creating and interpreting this critical document. You’ll also learn about the key components of a cash flow statement, helping you gain insights into your business’s financial health.

Tracking Income and Expenses

Effective cash flow management begins with meticulous tracking of money coming in and going out. In this section, we’ll provide strategies for monitoring your finances and highlight the significance of accurate record-keeping. Every dollar counts in the world of small business, and a well-maintained ledger can make a world of difference.

Forecasting Cash Flow

The Importance of Cash Flow Forecasting

Preventing cash flow surprises is paramount for small businesses. Cash flow forecasting is your crystal ball. We’ll explore how forecasting can help you make strategic decisions, anticipate financial challenges, and ultimately steer your business toward success.

Building a Cash Flow Forecast

Creating a cash flow forecast might sound daunting, but we’ll break it down into a step-by-step guide. Learn how to utilize historical data and market trends to make your forecast as accurate as possible.

Long-term vs. Short-term Forecasting

Not all forecasts are created equal. We’ll help you understand the distinction between long-term and short-term cash flow forecasting and guide you on when to use each to your advantage.

Strategies to Improve Cash Flow

Increasing Revenue

Growing your revenue is a fundamental part of cash flow management. Discover revenue-boosting strategies designed specifically for small businesses. We’ll also delve into techniques for attracting new customers and retaining existing ones.

Reducing Expenses

Cost-cutting measures are often the quickest route to improved cash flow. We’ll explore ways to reduce expenses, streamline operations, and eliminate wasteful spending.

Efficient Billing and Collections

Inefficiencies in billing and collections can be a significant drain on your cash flow. Learn how to expedite these processes and consider offering discounts and incentives to encourage prompt payments.

Financial Tools and Technology

Cash Flow Management Software

The world of finance has gone digital, and so should your cash flow management. Get an overview of the software and tools available for cash flow management, along with the essential features to look for in your choice of software.

Online Banking and Mobile Apps

Digital banking platforms and mobile apps offer real-time cash flow monitoring. We’ll explore the advantages of these technologies and how they can bring convenience to managing your cash flow on the go.

Preventing Fraud and Ensuring Security

Securing Your Financial Data

Financial data is sensitive, and protecting it is paramount. We’ll discuss best practices for safeguarding your business’s financial information, including implementing access controls and encryption.

Fraud Prevention Measures

No business is immune to fraud. We’ll provide you with essential steps to safeguard against fraudulent activities and tips on detecting and responding to potential financial fraud.

Accessing Financing Options

The Role of Financing in Cash Flow Management

When your cash flow falls short, financing options can bridge the gap. Discover the types of financing available for small businesses and how they can provide a safety net for your cash flow.

Revolving Credit vs. Term Loans

Understanding the differences between revolving credit and term loans is crucial when seeking financial support. We’ll clarify the distinctions and guide you on when to choose one financing option over the other.

Conclusion

Summary of Key Takeaways

As we wrap up our exploration of cash flow management for small businesses, we’ll recap the main points discussed in the article. These key takeaways will serve as a quick reference for your cash flow management journey.

Empowering Your Small Business

It’s not just about knowledge; it’s about action. We’ll encourage small business owners to implement effective cash flow management strategies and take control of their financial future.

Moving Forward

To conclude, we’ll inspire readers to take immediate steps to enhance their cash flow management strategies. Small businesses can thrive with the right financial practices, and we’re here to support your journey.

Resources

Small Business Administration (SBA): Cash Flow Management

U.S. Chamber of Commerce: Cash Flow Management for Small Businesses

SCORE: Cash Flow Management

FAQ

Q: What is the primary objective of cash flow management?

A: Ensure sufficient cash to meet obligations.

Q: How can small businesses benefit from forecasting their cash flow?

A: Identify potential problems, make informed decisions, negotiate better terms, secure financing, manage inventory, improve profitability.

Q: Are there any free tools for managing cash flow?

A: Spreadsheet templates, online calculators, government resources, basic accounting software features.

Q: What are the risks of neglecting cash flow management?

A: Late payments, damaged creditworthiness, missed growth opportunities, business failure.

Q: Can cash flow management software integrate with accounting systems?

A: Yes, many solutions can seamlessly integrate.

Q: What financing alternatives are available for businesses facing cash flow challenges?

A: Short-term loans, lines of credit, invoice factoring, asset-based lending, government-backed loans.