Stop Throwing Money Away! The Ultimate Guide to Reducing Your Small Business Tax Bill

January 25, 2024

The Cheat Sheet Every Small Business Owner Needs: 7 Powerful Accounting Formulas for Financial Success

February 7, 2024Demystifying Cash Flow: What It Is and Why It Matters

Understanding cash flow isn’t just about crunching numbers, it’s about grasping the lifeblood of your business. Whether you’re a seasoned entrepreneur or just starting out, mastering cash flow is crucial for survival, growth, and peace of mind.

What Exactly is Cash Flow?

Cash flow simply refers to the movement of money in and out of your business. It’s all about the inflows you receive (sales, investments, loans) and the outflows you incur (expenses, debts, taxes). Think of it as the heartbeat of your business, constantly pulsating with every financial transaction.

Key Point: Cash flow is distinct from profit. While profit measures your overall earnings, cash flow reflects the actual cash entering and leaving your accounts. Think of it this way: you can show a profit on paper, but if your customers are slow to pay and your expenses are high, you might still face cash flow problems.

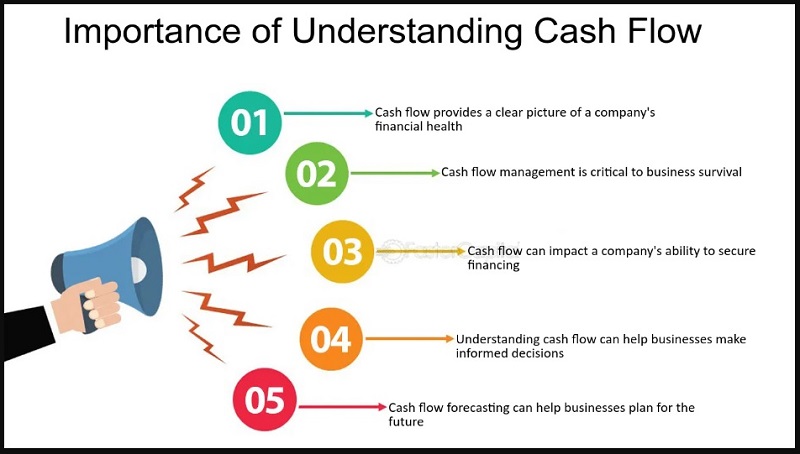

Why Does Cash Flow Matter So Much?

Here’s why understanding and managing cash flow effectively is critical for your business success:

-

Ensures Business Survival: Without sufficient cash to cover ongoing expenses, even profitable businesses can stumble. Positive cash flow guarantees you have the resources to pay the bills, keep the lights on, and operate smoothly.

-

Fuels Growth and Expansion: Positive cash flow provides the fuel for investments and expansion. It allows you to hire new talent, acquire equipment, and explore new markets, propelling your business forward.

-

Brings Financial Freedom and Peace of Mind: Steady cash flow translates to financial independence and control. Knowing you have enough cash to handle unexpected expenses or navigate slow periods brings peace of mind and allows you to focus on strategic growth.

Case Studies:

Imagine two businesses:

- Company A: Boasts high profits but struggles with slow-paying customers, leading to negative cash flow and ultimately, closure.

- Company B: Earns modest profits but prioritizes efficient operations and receivables collection, resulting in healthy cash flow and steady growth.

These contrasting scenarios highlight the immense impact of cash flow on a business’s fate.

Navigating the Different Types of Cash Flow

Now that we’ve grasped the fundamental concept of cash flow, let’s explore its different components:

Understanding the Three Cash Flow Categories:

Cash flow isn’t one-dimensional; it’s categorized into three distinct streams, each reflecting a vital aspect of your business operations:

-

Operating Cash Flow: This is the core cash flow generated by your regular business activities. Think of it as the cash you earn from selling products or services, minus the cash you spend on expenses like inventory, salaries, and rent. It reflects your company’s operational efficiency and profitability.

-

Investing Cash Flow: This captures the cash flow associated with acquiring or selling assets. It includes money spent on buying new equipment, property, or investments, as well as cash received from selling such assets. It reflects your investment activities and their impact on cash flow.

-

Financing Cash Flow: This encompasses the cash flow generated from debt and equity financing. It includes money borrowed through loans or lines of credit, as well as cash raised by issuing stocks. It reflects how you fund your business and manage your capital structure.

By analyzing each type of cash flow separately, you gain a deeper understanding of your business’s overall financial health and potential.

Deep Dive into Operating Cash Flow:

As the cornerstone of your business, operating cash flow deserves a closer look:

-

Key Components: It comprises:

- Net income from operations: Your profit after accounting for operating expenses.

- Non-cash expenses: Items like depreciation and amortization that reduce your profit on paper but don’t involve actual cash outflow.

- Changes in working capital: Fluctuations in accounts receivable, inventory, and accounts payable that impact your cash flow.

-

Analysis: By analyzing these components, you can assess your operational efficiency. A high operating cash flow ratio (operating cash flow divided by revenue) indicates your business is generating cash effectively from its core operations.

Investing Cash Flow: Examining Assets and Growth Strategies:

Let’s explore the cash flow implications of your investment decisions:

-

Capital Expenditures: Buying new equipment or property typically leads to negative cash flow, but these investments can generate future returns and improve your operational efficiency.

-

Acquisitions: Merging with or acquiring another company can have a significant impact on cash flow, depending on the deal structure and potential synergies.

-

Sale of Assets: Selling assets like property or equipment can provide a valuable inflow of cash, but it’s crucial to weigh the long-term impact on your business operations.

By carefully analyzing investing cash flow, you can make informed decisions about growth strategies and asset management.

Financing Cash Flow: Managing Debt and Equity:

Let’s see how debt and equity financing impact your cash flow:

-

Borrowing: Taking out loans or lines of credit provides immediate cash, but you incur interest expenses and repayment obligations, impacting future cash flow.

-

Issuing Stocks: Raising capital through issuing stocks doesn’t directly affect cash flow, but it dilutes ownership and may impact future dividend payments.

Understanding the impact of financing decisions on your cash flow is crucial for maintaining a healthy capital structure and financial stability.

FAQs: Common Cash Flow Concerns and Solutions

Q: How can I improve my negative cash flow?

- Analyze your cash flow statement to identify spending leaks and potential inefficiencies.

- Implement cost-cutting measures, negotiate better terms with suppliers, and accelerate receivables collection.

- Explore alternative financing options if necessary.

Q: What are some warning signs of cash flow problems?

- Declining cash reserves, increasing debt, late payments to suppliers, and difficulty covering operating expenses.

Q: How can I manage cash flow during slow business periods?

- Build a cash cushion beforehand, offer seasonal discounts, and negotiate flexible payment terms with customers.

- Explore temporary financing options and adjust your budget accordingly.

Q: What resources are available to help me with cash flow management?

- Government agencies like the SBA offer resources and guidance.

- Financial advisors and accounting professionals can provide tailored advice.

- Utilize online tools and software specifically designed for cash flow management.

Q: What are some best practices for budgeting and forecasting cash flow?

- Create a realistic budget based on historical data and industry benchmarks.

- Regularly review and update your budget to reflect changing circumstances.

- Utilize cash flow forecasting software to predict future cash flow needs.

Q: How can I automate tasks to improve cash flow efficiency?

- Utilize online payment processing and invoicing systems.

- Automate recurring expenses and schedule payments in advance.

- Integrate accounting software with other business systems for streamlined data flow.

Q: What role does inventory management play in cash flow?

- Efficient inventory management minimizes carrying costs and frees up cash tied up in unsold products.

- Implement just-in-time inventory practices to optimize cash flow.

Q: How can I secure financing to improve my cash flow?

- Explore various financing options like loans, lines of credit, or alternative financing solutions.

- Carefully consider the terms and interest rates associated with each option.

- Maintain a good credit score to qualify for favorable financing terms.

Resources

Anchor Text: SBA Cash Flow Guide

- U.S. Small Business Administration: Cash Flow Management for Small Businesses

Investopedia Cash Flow Analysis

- Investopedia: Cash Flow Analysis

AICPA Cash Flow Statement Guide

- American Institute of Certified Public Accountants (AICPA): Cash Flow Statement