Chart Your Course to Profit: Mastermind Your Small Business Budget

December 27, 2023

Do I need an accountant if I have a bookkeeper?

January 18, 2024Part 1: Taking Control: Building Your Small Business Financial Plan and Tracking Progress

Introduction:

For every ambitious entrepreneur, mastering the art of financial planning and tracking is a crucial step towards sustainable success. Ignoring your finances is like embarking on a voyage without a map or compass – you might stumble upon fortuitous winds, but reaching your destination is pure chance. In this guide, we’ll equip you with the tools and strategies to chart a clear course for your small business, ensuring you navigate the financial seas with confidence and precision.

Why Track Your Financial Progress?

Imagine steering your business blindly, unaware of fuel levels, course corrections needed, or even the final destination. Neglecting financial tracking leaves you in this very predicament. Without monitoring your progress, you’ll lack the critical insights to:

- Avoid cash flow pitfalls: Unforeseen expenses or delayed payments can cripple your business. Tracking keeps you prepared and proactive.

- Make informed decisions: Every choice impacts your financials. Data-driven decisions based on accurate tracking lead to better outcomes.

- Seize opportunities: Hidden gems like cost-saving avenues or profitable investments often lie within your financial data. Tracking reveals them.

- Achieve your goals: Whether it’s ambitious growth or steady sustainability, tracking ensures you stay on course and adjust your sails as needed.

Setting SMART Goals for Success

Goals are the lighthouses guiding your business voyage. But vague aspirations won’t get you far. We need SMART goals:

- Specific: Define your desired outcome clearly. “Increase revenue” is vague, “Grow online sales by 20% in Q1” is specific.

- Measurable: Quantify your goal. This allows you to track progress and celebrate milestones.

- Attainable: Set ambitious yet achievable goals. Unrealistic aspirations lead to discouragement.

- Relevant: Ensure your goals align with your overall business vision and values.

- Time-bound: Set deadlines to create a sense of urgency and track progress effectively.

Choosing Your Key Performance Indicators (KPIs)

Think of KPIs as your navigational instruments. They tell you if you’re on track towards your goals, revealing potential obstacles or hidden currents. Common KPIs for small businesses include:

- Revenue: How much money is coming in? Are you meeting sales targets?

- Expenses: Where is your money going? Can you optimize spending?

- Profit Margin: How much profit are you generating from each sale? Is it improving?

- Customer Acquisition Cost: How much does it cost to attract a new customer? Can you optimize marketing channels?

- Conversion Rate: How many leads turn into paying customers? Can you improve the sales funnel?

Once you define your goals, choose KPIs that directly measure progress towards achieving them.

Building Your Comprehensive Financial Plan

Your financial plan is the blueprint for your financial journey. It includes:

- Income Statement: Projects your expected revenue and expenses to understand your profitability.

- Balance Sheet: Snapshots your assets (what you own) and liabilities (what you owe) at a specific point in time.

- Cash Flow Statement: Tracks the movement of money in and out of your business, crucial for managing short-term liquidity.

Several types of financial plans can guide your navigation:

- Business Plan: Outlines your long-term vision, strategies, and financial projections.

- Budget: Allocates your resources towards specific goals and tracks spending against the plan.

- Cash Flow Forecast: Predicts future cash inflows and outflows to manage short-term needs.

Utilize accounting software, templates, or even simple spreadsheets to create your plan. Remember, it’s a living document – update it regularly to reflect changing circumstances.

Establishing a System for Tracking Your Progress

Now, let’s set up your financial observation deck! Choose tools that work for you:

- Spreadsheets: Simple and flexible, but data entry and analysis can be time-consuming.

- Accounting Software: Offers automation, features, and reporting capabilities, but can have a learning curve and cost.

- Dashboards: Visually present key metrics for easy monitoring and analysis.

Set a regular schedule for data entry and analysis. Consider automation tools to streamline data collection and save time. Regular monitoring, not occasional glances, is key to staying on course.

Part 2: Navigating the Currents: Monitoring, Analyzing, and Adapting Your Financial Course

In Part 1, we laid the foundation for mastering your small business finances. Now, let’s dive deeper into the art of monitoring, analyzing, and adapting your plan based on progress.

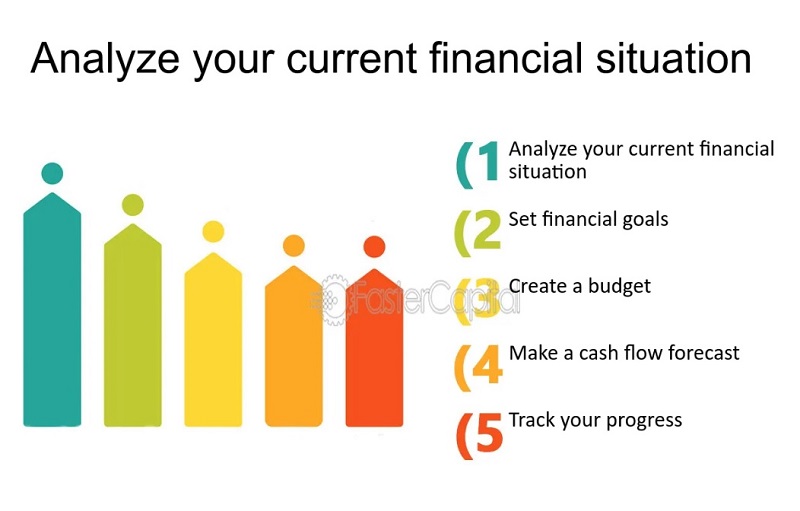

Analyzing Your Financial Data and Interpreting the Results

Your financial data is a treasure trove of insights. But simply collecting it isn’t enough. We need to decipher its meaning:

- Key Financial Ratios: Calculate ratios like liquidity, profitability, and efficiency to assess your financial health and compare it to industry benchmarks.

- Trends and Patterns: Look for trends in your data over time. Are certain expenses rising? Is revenue growing steadily? Identifying patterns reveals underlying factors influencing your progress.

- Goal Alignment: Are your metrics moving you closer to your SMART goals? If not, it’s time to adjust your course.

Understanding these findings empowers you to make informed decisions and optimize your financial performance.

Making Adjustments to Your Financial Plan Based on Your Progress

Financial plans are not static maps; they’re adaptable charts. Be prepared to adjust your course based on your analysis:

- Refine Budget Allocations: Did specific expenses exceed expectations? Can you reallocate funds to more profitable areas?

- Revise Goals and KPIs: If market conditions change or you uncover new opportunities, adapt your goals and KPIs accordingly.

- Implement Corrective Actions: Identify areas of underperformance and implement corrective measures. Did marketing campaigns underperform? Time to restrategize!

Embracing flexibility ensures your financial plan remains a relevant guide throughout your business journey.

Common Challenges Faced by Small Businesses in Tracking Financial Progress

Even seasoned navigators encounter storms. Here are some common challenges and tips to overcome them:

- Lack of Time and Resources: Time management is crucial. Utilize automation tools, outsource tasks, and prioritize key data points.

- Difficulty Interpreting Data: Don’t be afraid to seek help! Accountants and financial advisors can demystify your data and offer valuable insights.

- Sticking to the Plan and Making Regular Adjustments: Review your plan regularly and adjust as needed. Consistency is key, but don’t be afraid to course-correct when necessary.

![]()

Benefits of Seeking Professional Help with Financial Planning and Tracking

Sometimes, hiring a financial expert is the best investment you can make:

- Expertise and Guidance: Professionals offer their knowledge and experience to analyze your data, identify opportunities, and optimize your plan.

- Advanced Tools and Resources: They have access to sophisticated tools and resources to provide in-depth financial analysis and forecasting.

- Objectivity and Accountability: An objective perspective can reveal blind spots and hold you accountable for progress.

Consider seeking professional help when tackling complex financial decisions, expanding your business, or needing additional expertise.

FAQs About Small Business Financial Planning and Tracking Progress

Q: What are the best accounting software for small businesses?

- A: Research your options based on your specific needs and budget. Popular choices include QuickBooks, Xero, and Wave.

Q: How often should I review my financial plan?

- A: At least quarterly, and adjust as needed based on performance and changing circumstances.

Q: What are some warning signs of financial trouble?

- A: Declining revenues, increasing expenses, cash flow shortages, and missed payments are potential red flags.

This concludes your comprehensive guide to building, monitoring, and adapting your small business financial plan. Remember, consistent tracking, data analysis, and flexibility are key to navigating the financial seas and steering your business towards success.

Resources

Small Business Administration: Financial Management Resource Guide

- Get expert guidance and resources from the SBA to improve your small business financials.

SCORE: Financial Planning Toolkit for Small Businesses

- Access FREE financial planning templates and tools from SCORE to create a roadmap for your business success.

Fundbox: The Ultimate Guide to Financial Planning for Small Businesses

- Discover this comprehensive guide by Fundbox packed with practical tips and strategies for small business owners.